Stocks are currently on an unstoppable hot streak, with eight straight sessions in the green for the S&P 500 (SPX), the longest winning streak since last November. Undoubtedly, Technology stocks are leading the way higher, just a few weeks after many investors thought the market would tank and the less loved mid-caps and value plays would lead us higher. With Tech stocks in the driver’s seat again, it is also time for many to revisit the drawing board for the value of the latest swoon.

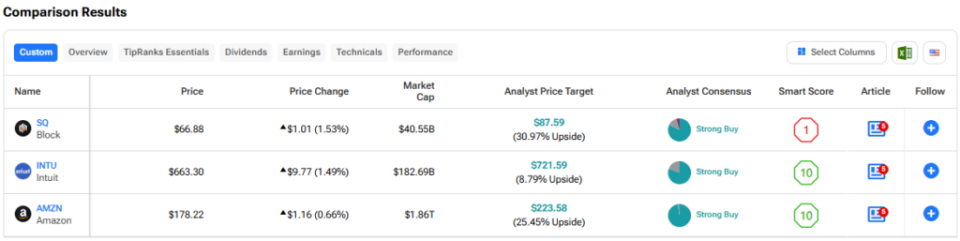

In this section, we’ll examine the TipRanks Comparison Tool to gauge which trio of tech titans — SQ, INTU, and AMZN — will fare the best in the coming year, according to Wall Street analysts.

Block, formerly known as Square, is a financial technology company (having a Cash App and other services) whose shares have been choppily consolidating in a wide range of new years. It’s true that stocks have broken the hearts of many investors, but the tide may be turning.

Recently, Bank of America (BAC) issued a table on SQ shares, noting “undervaluation” and “underappreciation”. With negligible catalysts (think major corporate restructuring) on the horizon, I remain bullish on the stock.

Now down nearly 9% in the past two years and 13.5% year-to-date, SQ stock looks like the Tech sector. Despite beating well on earnings over the past two quarters, the stock lacks the excitement factor it once had. Whether it’s the lack of blockchain innovation or the operational challenges that led CEO and “Block Chief” Jack Dorsey to reorganize the entire company, investors are demanding more from these companies in the age of AI. Whether the company’s reshuffling last month helped Blok regain its competitive spirit remains to be seen.

Regardless, the company has plans to get back on the high street. Specifically, the company’s “Rule 40” in 2026 plans to set a fairly high (but realistic) bar, with gross profit and operating income targets set at 15% and 25% (total 40%).

Bank of America analyst Jason Kupferberg, who has a Buy rating on the stock and a $82.00 price target per share that represents more than 22% upside, praised Block for having “demonstrated good progress” on Rule 40. As Block pushes for greater efficiency great. , really need to introduce new innovations to jolt sales. Introducing new financial services in the Cash App ecosystem (such as Cash App Borrow) is worth banking on.

What is SQ’s stock price target?

SQ stock is a Strong Buy, according to analysts, with 24 Buys, six Holds, and one Sell assigned over the past three months. SQ’s average stock price target of $88.90 indicates a potential upside of 32.9%.

Read more SQ Analyst ratings

Shares of financial technology software company Intuit (mostly known for its tax filing software, TurboTax) are flirting with new highs again, now down more than 5% from their all-time high and 2% away from their 52-week high. Certainly, the $670 resistance ceiling has proven challenging to penetrate over the past six months. As companies look to lay off and rehire with AI in mind, perhaps investors seeking the “monetization of AI” play will love more than the name from a long-term perspective. Although multiples have increased in value over the past few weeks, I tend to remain bullish on INTU stock.

Intuit is serious about AI-driven growth. But unlike many other companies that prefer to invest rather than underinvest (think Alphabet ( GOOGL ) ), Intuit is serious about keeping its balance sheet in good shape while emphasizing operating efficiency. As more investors reward their AI investment than the ambition of their AI narrative and the size of their spending budget, Intuit may be one of the companies that starts to stand out from the pack, if it hasn’t already.

Intuit’s AI offering, Intuit Assist, is an innovative tool designed to increase productivity in financial software by providing AI-driven assistance and insights. Over time, it can become very monetizable, similar to how Microsoft (MSFT) has successfully monetized Copilot. Whether Intuit can achieve similar success remains to be seen, but it’s clear that financial software is a sector poised for significant AI-driven disruption, and Intuit is well positioned to ride the wave.

Indeed, Intuit will add enormous value to users by deploying generative AI in QuickBooks, TurboTax, Credit Karma, and Mailchimp to improve the user experience. With creating value comes the opportunity to charge higher prices. At the end of the day, users will be more willing to open more wallets if there’s more value, whether it’s in the form of time savings or increased accuracy.

The lowest value of INTU in 2019 is 34.7 ₩. Given the real opportunity to monetize AI and a generative AI operating system (GenOS) built from the ground up, I’d argue the premium is worth paying.

What is INTU’s stock price target?

INTU shares are a Strong Buy, according to analysts, with 18 Buys and four Holds assigned over the past three months. INTU’s average stock price target of $722.61 indicates a potential upside of 8.9%.

Read more INTU analyst ratings

Shares of e-commerce and cloud giant Amazon cratered in July and earlier this month as the market sell-off dragged down the Nasdaq 100 (NDX) to the correction region. Of course, it wasn’t just investors who were fighting technology that caused AMZN stock to tumble nearly 25% from peak to trough. The company’s most recent quarter left a lot to be desired.

In any case, AMZN stock has a chance to take the relief rally into high gear as investors focus on the road ahead and the growth drivers that could help the company rise. As one of the better buy-the-dip opportunities right now, I tend to remain bullish on the stock.

Looking ahead, look for Amazon to reveal more specifics about how it plans to take on Chinese e-commerce rivals like PDD Holdings’ ( PDD ) Metu in the lowest-cost spectrum.

Of course, Amazon has a lot of market share to take on the cheapest e-commerce, and I think Amazon has more than enough tools to get the job done and done well. The behemoth Magnificent Seven certainly does logistics better than most. However, the big question remains whether it is possible to minimize the cost and time of shipping goods coming from China.

As Amazon’s low-end market comes to life this fall, it’s possible that some of the enthusiasm for PDD stock could spill over to AMZN. As the initial review is released, we will be able to see what could be one of the ways of great growth at Amazon. At 42.4 times trailing P/E, AMZN is still more valuable than most of its Magnificent Seven peers. However, given the opportunity to steal Temu’s lunch and continue to advance on the AI front (Amazon just bought another AI company, Perceive, a few days ago), the premium is worth it.

What is AMZN’s stock price target?

AMZN stock is a Strong Buy, according to analysts, with 41 Buys and one Hold assigned over the past three months. AMZN’s average stock price target of $223.58 indicates a potential upside of 25.5%.

Read more AMZN analyst ratings

The Takeaway

There are many undervalued Tech stocks that have room to move higher as the market rebounds. Whether we’re talking about Block and its advancements in the “Rule of 40,” Intuit and its exciting AI monetization opportunities, or Amazon and its potential upcoming Meet rival, the following trio have catalysts to work on. Of the trio, Wall Street sees the most (33%) in SQ stock. I tend to agree with the analysts. If Jack Dorsey can right the ship, SQ stock could make a comeback.

disclosure