In the midst of the artificial intelligence (AI) boom, stocks from Nvidia (NASDAQ: NVDA) and District Super Micro Computer (NASDAQ: SMCI) have torched the stock market in 2024, making gains of 166% and 197%, at the time of this writing. Thanks to the overwhelming demand for AI-enabled hardware, they have experienced an impressive acceleration in revenue and earnings.

Nvidia’s dominance in the AI chip market has translated into phenomenal growth, and Super Micro Computer is not far behind. Data center operators assemble modular server solutions to mount AI chips sold by Nvidia and other companies. However, if you want to add AI stocks to your portfolio and want to choose between the two, which one should you buy now?

The case for Nvidia

Nvidia is reported to dominate 94% of the AI chip market by the end of 2023. The company’s results for the first quarter of fiscal 2025 (which ended on April 28) show that this dominance will continue to grow for the rest of the year. .

Revenue grew 262% last year to $26 billion. Impressive pricing power led to a 461% increase in adjusted earnings to $6.12 per share. Management’s $28 billion revenue guidance for the current quarter shows that the top line is on track to jump 107% year-over-year, which would be an acceleration from the 101% growth it posted in the same period last year.

However, the emerging growth path in the emerging AI market suggests that Nvidia may be better than that. For example, governments around the world are reportedly spending huge amounts of money on AI infrastructure, and state investment in AI technology is expected to contribute $10 billion to Nvidia’s top line this fiscal year, compared to nothing in the past.

More specifically, the government is seeking to create a large language model (LLM) in local languages based on country-specific data. In Nvidia’s May conference call, management stated that Japan, France, Italy, and Singapore have invested in AI infrastructure. He expects more countries to join the bandwagon. “The importance of AI has caught the attention of every country,” said CFO Colette Kress.

Saudi Arabia, for example, reportedly wants to invest $40 billion in AI initiatives, while China’s AI-focused spending is forecast to exceed $38 billion by 2027. Meanwhile, major Indian companies such as Tata Group and Reliance Industries rely on Nvidia chips. train LLMs.

In short, Nvidia’s customer base is diverse beyond the major cloud infrastructure providers that have deployed massive amounts of chips to train and deploy AI models. Spending on AI chips is expected to grow more than 10-fold over the next decade, reaching $341 billion by 2033 compared to $23 billion last year. The stage seems to be set for Nvidia to maintain its incredible growth as it needs to take strong steps to ensure that it remains the dominant player in this space.

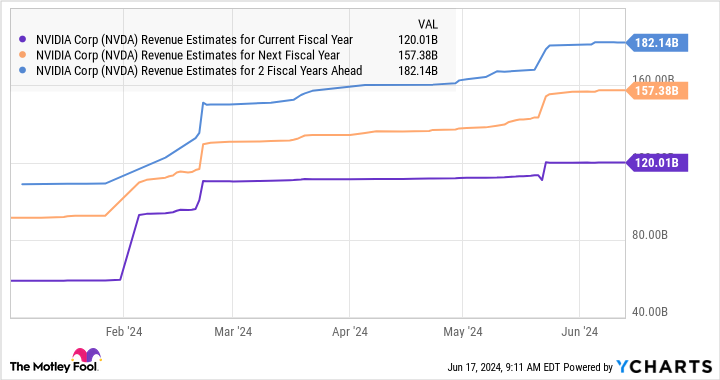

That’s why analysts forecast that the company’s top line will continue to grow rapidly from fiscal 2024 to nearly $61 billion.

As such, Nvidia should remain the top AI stock as the race to develop AI applications by companies and governments has created secular growth opportunities.

Case for Super Micro Computer

Supermicro’s growth is entwined to some extent with Nvidia. Data center operators need server rack solutions of the type sold by Supermicro to mount processors sold by Nvidia and other chip makers. So, it’s not surprising that the demand for Supermicro servers has disappeared.

In the third quarter of fiscal 2024, which ended on March 31, the revenue increased by 200% year over year. Non-GAAP net income per share, meanwhile, rose 307%. So, Supermicro is not far behind Nvidia when it comes to how AI has supercharged its fortunes. The company is guiding for revenue of $14.9 billion in the current fiscal year, which ends this month. That would be a big jump from the $7.1 billion in revenue it reported in fiscal 2023.

More importantly, analysts expect the top line to nearly double over the next few fiscal years.

The bright side is that Supermicro can sustain healthy growth beyond the next few fiscal years. This is because the demand for AI servers is expected to expand at a compound annual rate of 25% until 2029. The market is expected to generate annual revenue of nearly $73 billion after five years, rising from $17.5 billion in 2022.

Supermicro is growing faster than the current AI server market. As it turns out, the growth is faster than more established companies such as Dell Technologies, which has sold $3 billion worth of AI servers over the past three quarters. Supermicro made $9.6 billion in the past three quarters and got more than half of its revenue from selling AI-related server solutions.

Supermicro has managed to make a dent in the AI server market despite the presence of larger players. In addition, with the steps taken by the company to increase its production utilization rate and production capacity, it may gain a larger share of the AI server market in the future.

Like Nvidia, even Supermicro looks like a solid long-term AI play. But is it worth buying over Nvidia?

Verdict

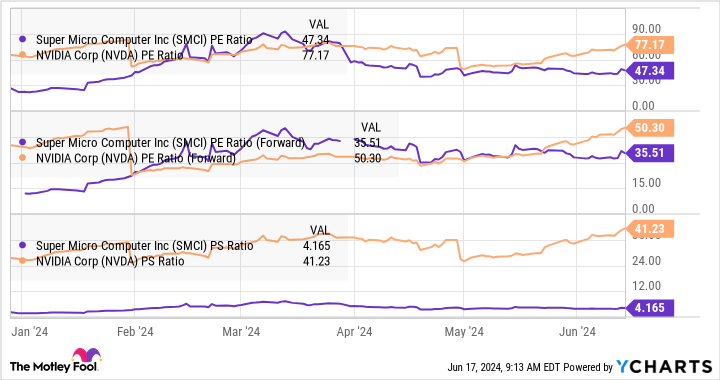

Nvidia and Supermicro are high-growth companies benefiting from the proliferation of AI. So the investor’s choice of which stocks to buy will now come down to their value. Supermicro is inferior to Nvidia in terms of revenue and sales.

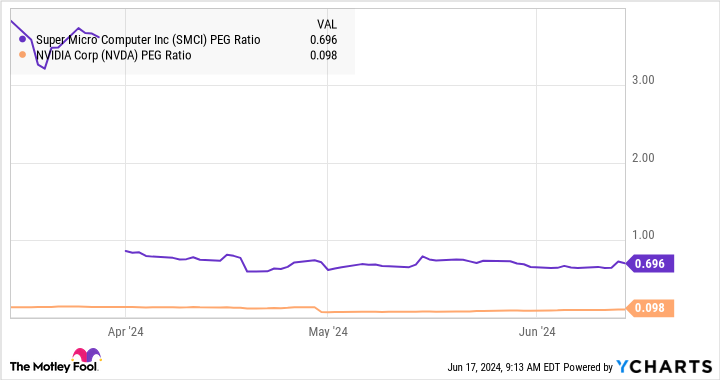

However, when it comes to price/earnings-to-growth (PEG) ratios, the story is a bit more interesting. The metric is a forward-looking valuation determined by dividing a company’s past earnings multiple by the earnings growth it is expected to deliver in the future. Any (positive) PEG ratio below 1 is viewed by most investors as indicating a cheap stock. And on that metric, Nvidia and Supermicro are undervalued.

So with at least one step forward, both Nvidia and Supermicro are attractive buys right now for anyone looking to add growth stocks to their portfolio. More importantly, both companies seem to be able to generate the tremendous growth that the market expects, given the excellent opportunities. And that’s why investors may consider buying one of the stocks, even if it’s made a good profit this year.

Should you invest $1,000 in Nvidia right now?

Before buying shares in Nvidia, consider this:

At Motley Fool Stock Advisor The team of analysts only recognized what they believed it to be 10 best stocks to buy investors now… and Nvidia is not one of them. 10 stocks that made the cut could produce monster returns in the coming years.

Try when Nvidia created this list on April 15, 2005… if you invest $1,000 when you recommend, you will have $830,777!*

Stock Advisor gives investors an easy-to-follow blueprint for success, including portfolio-building guidance, regular updates from analysts, and two new stock picks every month. At Stock Advisor service already more than four return of the S&P 500 since 2002*.

View 10 stocks »

* The Stock Advisor returns on June 10, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has a position and recommends Nvidia. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stocks: Nvidia vs. Super Micro Computer was originally published by The Motley Fool