One of Wall Street’s most controversial investment strategies might be less beleaguered today if its defenders had shown more moderation from the start, according to Kyle Bass.

Content of the article

(Bloomberg) — One of Wall Street’s most controversial investment strategies might be less beleaguered today if its defenders had shown a little more moderation from the start, according to Kyle Bass.

The hedge fund veteran and founder of Hayman Capital Management says the backlash against environmental, social and government investments in recent years is due to climate activists’ demands that fossil fuels be abandoned here and now. As a proposition, one cannot do or take responsibility, he said.

Advertising 2

Content of the article

“There are all these idiots who just say, if somebody does hydrocarbons, we’re going to put them out of business or get capital,” Bass said in an interview. “That’s why Texas stepped back and said, if you’re going to sell people who produce hydrocarbons, we’re not going to do business with you either.”

This is the line of argument that is at the heart of the growing conflict between Wall Street and the climate movement. The latest case is a months-long campaign outside the Manhattan headquarters of Citigroup Inc., which has seen tensions between bankers and protesters.

Protest organizers have galvanized enthusiasm using slogans like “Hot People Hate Wall Street” and “Eat the Rich.” So far, dialogue has been limited and neither side has made concessions.

Bass, who has spoken up in favor of agendas on various sides of the US political debate including tariffs in China for abortion rights, is the latest in a list of increasingly vocal financial professionals to characterize such climate activism as naive. Others who have made similar points include the founders of KKR & Co. Henry Kravis, also chief executive of JPMorgan Chase & Co. and Goldman Sachs Group Inc., Jamie Dimon and David Solomon.

Content of the article

Advertising 3

Content of the article

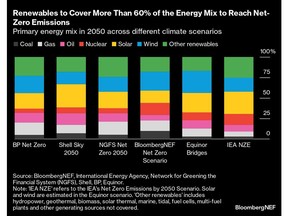

“The energy transition takes 40 or 50 years,” Bass said. There are people who “think we can just turn off hydrocarbons and turn on alternative power. But they don’t know how the grid works and they don’t understand how business works.

The focus now should be on energy efficiency and electrification, with a full transition to nuclear in the long term, he said. Until then, it’s more realistic to accept that fossil fuels and renewable energy sources “will coexist for decades and decades to come,” Bass said.

Many Wall Street firms that initially signed on to net zero alliances have since faced bans in Republican states that target companies that appear hostile to fossil fuels. Those same companies are now becoming more vocal in supporting their oil and gas clients.

“Hydrocarbon skirting is like bringing politics into investing,” Bass said. “If you’re willing to give up the return for that, then so be it. But I think it’s naive and a breach of fiduciary duty.

Texas, where Bass is based, passed two laws in 2021 that would limit government contracts with companies that take what state officials see as a punitive stance against the fossil fuel and firearms industries. The law, which is now being challenged in court, has prompted state officials to restrict financial firms including Citigroup, Barclays Plc and BlackRock Inc.

Advertising 4

Content of the article

The Sunrise Project, a non-profit organization focused on the financial sector’s contribution to global warming, said the legislation was a “bad faith” attempt to “punish financial service providers for managing investment risks.” The group points to evidence that laws like the one in Texas are ultimately costing taxpayers money.

At the same time, climate scientists are warning that the planet is reaching tipping points as rising emissions cause floods, forest fires and droughts. The continued bankrolling of fossil fuels directly increases these emissions contributing to climate catastrophe and must be reversed as soon as possible, he said.

Meanwhile in Europe, home to the world’s largest ESG investment rulebook, regulators are adjusting their stance. There is currently an extensive review of existing regulations with the aim of allowing a less absolutist stance on fossil fuels. In essence, investors who can demonstrate that they help companies with a large carbon footprint transition to a greener future can be called ESG strategies.

Advertising 5

Content of the article

ESG investors have begun to adjust their strategies to reflect expectations that regulations will be more favorable to the fossil fuel sector. A new study by analysts at Goldman Sachs found that ESG funds are now more active in the oil and gas industry than they were just a year ago.

Changes in the ESG regulatory background in Europe “could drive flows to companies that are not desirable,” according to a team of Goldman analysts that includes Evan Tylenda and Grace Chen.

Meanwhile, Bass itself is adapting to a greener future by targeting investment projects that protect the natural environment. Since 2021, he has been buying land through his private equity company, Conservation Equity Management, with the goal of protecting the forest from overexploitation and monetizing environmentally fragile habitats.

Bass, who was shot to fame after successfully betting on US subprime home loans during the 2008 financial crisis, said there is a clear opportunity to make money from nature conservation. In fact, he says he sees enough demand from external investors to allow him to develop his strategy.

Advertising 6

Content of the article

“We’re focused on reducing or offsetting our physical impact on the environment,” Bass said. “And we’re going to make good money doing it.”

Part of Bass’s efforts include generating mitigation banking credits, which are trading units that can be purchased by companies required by law to offset their environmental impacts.

Whether it’s a renewable energy developer or an oil producer, companies still have to compensate for the damage they’re doing to nature, Bass said.

Ultimately, Texas’ support for fossil fuel producers “just makes it better” for investment strategies like his related to offset sales, Bass said.

—With assistance from Lisa Pham.

Content of the article