The market is warm to ON Semiconductor (NASDAQ: ON) second quarter earnings report, and the stock has now outperformed significantly Nvidia over the last month, with a 14.2% increase compared to a 5.4% decline for the Darling stock market (as of this writing). The question of why and whether it can continue.

A cyclical stock to buy

ON Semiconductor serves two highly cyclical end markets, namely automotive (electric vehicles, power management, advanced driver assistance systems, etc.) and industry (auto, EV infrastructure, machine vision, etc.), which declined this year for various reasons .

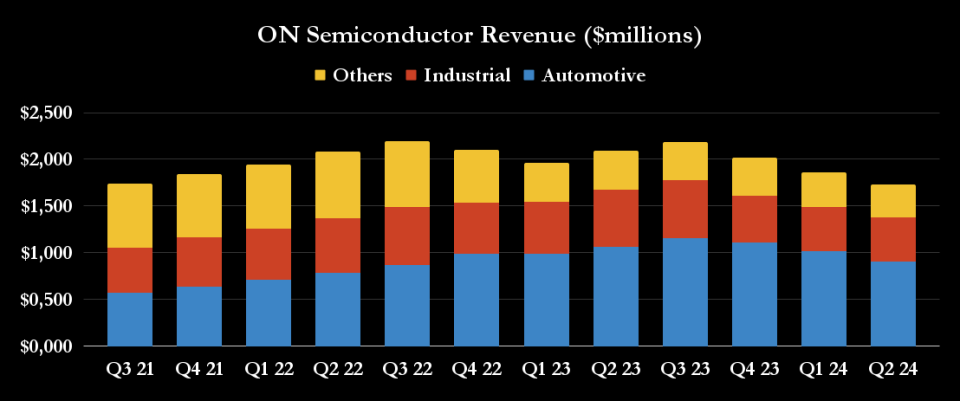

The chart below shows a sequential revenue decline trend starting in the third quarter of 2023. In addition, management expects the year-over-year decline to continue in the third quarter, with guidance for revenue of $1.7 billion to $1.8 billion, compared to a non-compliant $2.18 billion is reported in the third quarter of 2023.

However, in the sign of stabilization, the midpoint of the guidance of the third quarter shows a increasing sequence in revenue of $ 1.74 billion only reported in the second quarter. This is one of the reasons why investors buy the stock after the recent results. In other words, they are looking at the forecast for sequential improvement and take it as a potential bottoming process in action.

This is an interesting point of view, especially since semiconductor stocks are considered highly cyclical. The optimal time to buy is often during the darkest hours before the recovery light appears. Arguments like that ON Semiconductor can surpass Nvidia. As growing interest and investment in AI applications drive demand for high-performance computing (HPC) chips, the latter has been firing on all cylinders.

Is ON Semiconductor on the road to recovery?

The critical question here is not only whether recovery will come, but what kind of recovery it will be. While investors usually look for a V-shaped recovery, ON Semiconductor’s CEO, Hassane El-Khoury, does not share this view. He continues to predict an “L-shaped curve” for the recovery. In plain English, this means that there won’t be a dramatic increase in sales, but rather that revenue will decline and then bottom out.

This may not be what investors want, especially if buying ON Semiconductor is a typical semiconductor recovery play. However, El-Khoury’s cautious approach is perfectly understandable under the circumstances.

Relatively high interest rates make monthly payments on car loans more expensive, which has a negative impact on car sales, including EV sales. In turn, automakers are pulling back EV investments – bad news for ON Semiconductor, which is positioning itself in the market for smart power solutions for EVs.

In addition, the industrial end market, as illustrated by industrial automation, is struggling to increase orders as customers continue to reduce their built-up inventory while product lead times are longer, and need to build inventory for service requests. I have discussed this dynamic with regard to Rockwell Automation previous.

It’s true that ON Semiconductor’s end market has deteriorated until 2024.

Is ON Semiconductor still buying

While the short-term outlook remains uncertain, there is no doubt that the company will grow in the long-term. Besides, it’s only a matter of time before the market finally recovers. History shows the interest rate cycle will recede, and it won’t recede from a future where EV sales outpace internal combustion engine (ICE) sales – ON Semiconductor has more intelligent power and sense of chip content in EVs than in ICEs.

Indeed, as a sign of business potential, the company announced that “Volkswagen Group has chosen Onsemi to be the main supplier of complete power grid solutions as part of its next generation traction inverter for scalable system platform.

In addition, industrial automation is the future in countries with relatively high labor costs and a solution for reshoring production effectively. Investments in automation will likely increase as end-use demand picks up, and distributors reducing inventory now will only make the recovery stronger when it comes.

Finally, whether it is an L-shaped recovery or a V-shaped recovery, or even an L-shaped recovery that is a hockey stick, ON Semiconductor’s value, trading at 18.6 times the Wall Street estimate for earnings in 2024, is very attractive and quite capable. from continuing to exceed Nvidia.

Should you invest $1,000 in ON Semiconductor right now?

Before you buy shares in ON Semiconductor, consider this:

At Motley Fool Stock Advisor The analyst team only recognized what they believed it to be 10 best stocks for investors to buy now… and ON Semiconductor is not one of them. 10 stocks that made the cut could produce monster returns in the coming years.

Try when Nvidia created this list on April 15, 2005… if you invest $1,000 when you recommend, you have $657,306!*

Stock Advisor gives investors an easy-to-follow blueprint for success, including portfolio-building guidance, regular updates from analysts, and two new stock picks every month. At Stock Advisor service already more than four return of the S&P 500 since 2002*.

View 10 stocks »

* The Stock Advisor returns on July 29, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Nvidia and Volkswagen Ag. The Motley Fool recommends ON Semiconductor. The Motley Fool has a disclosure policy.

Can This Hot Semiconductor Stock Beat Nvidia? this was originally published by The Motley Fool