In this section, I evaluate two semiconductor stocks, Taiwan Semiconductor Manufacturing (NYSE: TSM) and Broadcom (NASDAQ: AVGO), use the TipRanks Comparison Tool to see which buys are better. A closer look shows TSM’s bullish view and Broadcom’s neutral view.

Taiwan Semiconductor Manufacturing produces and sells semiconductors for a number of end markets, including game consoles, servers, tablets, and computers, the automotive market, the Internet of Things, and other digital consumer electronics. On the other hand, Broadcom’s chips target the renewable energy, automotive, military and aerospace, industrial, and robotics markets.

TSM stock is up 71% year-to-date and up 76% over the past year. Meanwhile, Broadcom shares have jumped 49% year-to-date and are up more than 100% in the past year.

TSM and Broadcom’s disparate 12-month returns show concern among some Americans who hold Taiwan stocks.

China has long viewed Taiwan as part of its territory – even though Taiwan rules itself. As a result, China has increased its threats and military exercises around the small island. Of course, such uncertainty is enough to make many investors nervous, but there is another story when comparing TSM and Broadcom.

We will compare the price-to-earnings (P/E) ratio to measure the valuation of each other and the industry. For comparison, the semiconductor industry trades at a P/E of 68.8x compared to a three-year average of 34.6x.

Taiwan Semiconductor Manufacturing (TSM) today.

At a P/E of 34.4x, Taiwan Semiconductor Manufacturing trades at a steep discount to Broadcom and many other US semiconductor names. In addition, without TSM, some of the world’s most famous semiconductor names would have no products. Thus, a bullish view seems appropriate.

The biggest difference between TSM and Broadcom is that TSM operates as a foundry, meaning it makes chips for other companies like Intel (NASDAQ: INTC). In fact, TSM is the world’s largest contract chip maker, and it’s the one that actually produces the artificial intelligence chips that have pushed Nvidia’s (NASDAQ:NVDA) share price is higher and higher in recent years.

On Tuesday, TSM’s stock rose after DigiTimes reported that Intel has selected the company to make new 3-nanometer chips for new notebook computers. DigiTimes had reported in May that TSM was already at a 95% utilization rate for 3-nanometer production, so adding Intel chips could bring the company to full or close to that.

Given how high the utilization rate of TSM and how cash-rich customers are, it is clear that the company has the power to raise prices, so we can expect revenue growth to remain strong. The company is also building three new fabrication facilities in Arizona to support more customers while tapping into US incentives for domestic semiconductor manufacturing.

Some investors are still concerned that TSM is a Taiwanese company. However, it is worth noting that American Depository Receipt (ADR) shares listed in the US are trading at a premium of more than 20% to shares listed in Taiwan – the largest gap in more than 10 years.

As the gap widens, it suggests investors may be less concerned about long-standing geopolitical concerns. Additionally, when TSM moved some of its manufacturing outside of Taiwan, the potential risks associated with investing in the company fell.

Therefore, this could be a good time to buy this deeply discounted stock before it starts to approach valuations according to major US chip makers like Broadcom and Nvidia.

What is TSM’s stock price target?

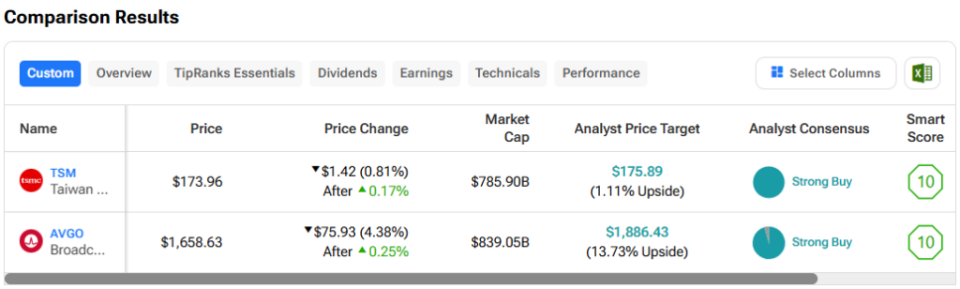

Taiwan Semiconductor Manufacturing has a consensus rating of Buy Strong based on 11 Buys, zero Holds, and zero Sell ratings assigned in the last three months. At $170.33, the average TSM stock price target indicates a potential downside of 2.1%.

Broadcom (NASDAQ:AVGO)

At a P/E of 74.6x, Broadcom trades at a premium for the industry but in line with top AI chipmakers like Nvidia, which has a P/E of 76.5x. At its current price, Broadcom is trading roughly in line with its last two peaks in December 2020 and February 2021, when it traded at a P/E just below 80x. Thus, a neutral look seems appropriate – wait for a more attractive entry price.

Broadcom is largely a fabless semiconductor company, meaning it outsources chip manufacturing to foundry operators like TSM. In fact, TSM will produce 90% of Broadcom’s semiconductors by 2022, although Broadcom operates three smaller factories that represent a small portion of its business, according to its 2022 annual filing.

Broadcom shares received a significant bump after its latest earnings report on June 12, which was accompanied by the announcement of a 10-for-one stock split. AVGO shares have retreated since then, down about $100. However, a steeper decline is seen at the end, especially considering that the Relative Strength Index is above 70 this week (although it is finally down today), which indicates overbought territory. The downside is that we will have to wait a while to see better prices.

Broadcom will hold a 10-for-one stock split on July 12, and the stock will begin trading at the split-adjusted price on July 15. For investors looking for a bargain, the problem with a stock split like this is that it tends to temporarily boost the company’s stock price because more many investors are piling up stocks.

A stock split does not actually change the value of the company. It just makes the stock more accessible to retail investors who don’t have large portfolios and can’t or won’t pay $1,660 for one share. At $166 per share, Broadcom stock appear the price is more reasonable, but the overall price is the same because there were 10 times more stock when the price was cut to one-tenth of the current price.

Once we get past the stock split and the noise associated with it, it seems that more attractive entry prices are on the way.

What is the Price Target for AVGO Shares?

Broadcom has a consensus rating of Buy Strong based on 21 Buys, two Holds, and zero Sell ratings assigned in the last three months. At $1,886.43, Broadcom’s average stock price target indicates a potential upside of 13.7%.

Conclusion: Bullish on TSM, Neutral on AVGO

Taiwan Semiconductor Manufacturing and Broadcom are excellent semiconductor companies with long-term successful records and bright futures. However, TSM doesn’t get the glory of being the company that makes most of the chips that make Broadcom and others AI darlings.

At some point, TSM could achieve a P/E multiple in line with Broadcom, Nvidia, and others, so this seems like a good time to buy. On the other hand, Broadcom’s pricing is already looking full, so be patient for a better entry price.

disclosure