Producer of western movie “Rust” may have to forgo strong economic incentives in trying to sell the film to distributors and fulfill financial obligations to the cinematographer’s immediate family who fatally shot by Alec Baldwin during rehearsals in 2021.

New Mexico tax authorities rejected an application this spring by Rust Movie Productions for incentives worth $1.6 million, according to documents obtained by The Associated Press. The deadline of the end of July for producers to appeal the decision is approaching.

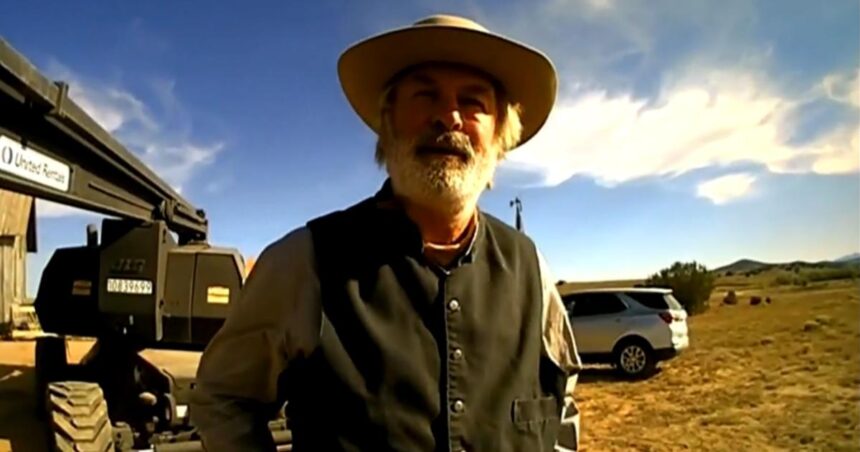

Meanwhile, Baldwin is scheduled to go on trial next week on charges of involuntary manslaughter Death of Halyna Hutchins. The main actor and co-producer of “Rust” is pointing the gun at Hutchins when he left, killed him and wounded director Joel Souza.

Melina Spadone, a lawyer representing the production company, said that the film production tax incentives will be used to fund legal settlements between the producer and Hutchins’ widower and son.

Andres Leighton / AP

“The denial of tax credits has disrupted these financial arrangements,” said Spadone, senior counsel in New York- and Los Angeles at Pillsbury Winthrop Shaw Pittman. He helped broker the 2022 settlement production reboot stuck from “Rust” in Montana with some of the original cast and crew, including Baldwin and Souza. Filming is over last year.

The terms of the settlement are confidential, but the producers said they completed the film to honor Hutchins’ artistic vision and raise money for his young son. When the settlement was announced, Baldwin called it a “tragic and painful resolution of the situation” on social media.

“During this difficult process, everyone has a special desire to do what is best for their son Halyna,” Baldwin said in the post.

Court documents show the settlement payment was delayed for up to a year, as attorneys for Hutchins’ widow determined what “next steps” involved proceed with the wrongful death lawsuit or start a new claim. Legal representatives for Matthew Hutchins did not respond to phone and email messages seeking comment.

Baldwin’s prosecution and the film’s tax incentive application have financial implications for New Mexico taxpayers. The Santa Fe district attorney’s office said it spent $625,000 on the “Rust” prosecution through the end of April.

What to know about New Mexico film incentives

New Mexico’s film incentive program is one of the most generous in the country, offering direct rebates of between 25% and 40% on various expenditures to entice film projects, employment and infrastructure investment. As a percentage of the state budget, only Georgia pays out more incentives.

It includes a one-time option to determine the payment to the financial institution. That allows producers to use rebates to underwrite production ahead of time, often layering the right to rebates and future film income into production loans.

Among those benefiting from the rebate program are the 2011 film “Cowboys and Aliens” and the TV series “Better Call Saul,” a spin-off of “Breaking Bad.” For the current production, New Mexico is the background of a new film starring Matthew McConaughey and America Ferrera about the rescue of students in the wildfires of 2018 in the city of Paradise – the most destructive in the history of California.

Charlie Moore, a spokesman for the New Mexico Department of Taxation and Revenue, declined to comment specifically on the “Rust” application, citing concerns about confidential taxpayer information. Applications are reviewed for a long list of accounting and statement requirements.

During the last 12-month period, 56 film incentive applications were approved and 43 were denied in part or in whole, Moore said.

Documents obtained by AP show that the New Mexico Film Office issued a memo in January for “Rust” that approved the right to apply for tax incentives, in a process that includes accounting ledgers, vetting outstanding debts and closing credits on the screen to New. Mexico is the filming location. The tax authorities have the final say on eligible expenses.

Spadone, the attorney for “Rust,” said the denial of the application was “outrageous” and could undermine confidence in the tax program with a chilling effect on the rebate-backed loans that fuel the local film industry.

AP photo/Jae C. Hong

Alton Walpole, a production manager at Santa Fe-based Mountainair Films who was not involved with “Rust,” said he blamed the film’s creators. apparently cutting corners on safety but officials have an obligation to re-apply tax credits based on legal and accounting principles only – or risk damage to major projects for other countries. The film is dangerous even without firearms on set, he said.

“They’ll say, ‘Wait, are we going to New Mexico? They can deny the rebate,'” Walpole said. “They watch every penny.”

“Popular opinion? I would say no rebate. But legally, I think he qualifies for everything,” he said.

At least 18 countries have adopted measures to implement or expand film tax incentives from 2021, while some have done the opposite and sought to limit transfers and credit refunds.

Under Democratic governor Michelle Lujan Grisham, New Mexico has raised the annual spending cap and expanded the film tax credit amid a multibillion-dollar surplus linked to record oil and natural gas production. Film rebate payments totaled $100 million in the fiscal year ending in June 2023 and are expected to rise to nearly $272 million in 2027, according to tax and budget and accountability agency records from the Legislature.

Democratic state senator George Muñoz has criticized the incentive program and questioned whether taxpayers should be responsible for unexpected costs.

“If we are going to make tax credits and there is a problem in the movie or the plane, do they really qualify or do they disqualify themselves?” said Muñoz, chairman of the budget writing committee Senate lead.

“Rust” doesn’t have a U.S. distributor yet because the producers shopped the film that just finished at the film festival.