Getty Images

Getty ImagesUK students will pay more for UK universities next year, as undergraduate tuition fees rise to £9,535 a year.

This is a £285 increase in fees, which have been frozen at a maximum of £9,250 since 2017.

Education Secretary Bridget Phillipson told MPs in Parliament on Monday that maintenance loans would also rise to help students manage their living costs.

The National Union of Students called rising tuition fees a “sticking plaster”, but said higher maintenance loans “will make a real difference to the poorest students”.

For universities, the higher fees are an injection of cash to help with the most pressing financial challenges.

However, the announcement only affects fees and borrowing in the 2025/26 academic year – and the vice-chancellor wants to know what the government’s plans are beyond that.

Phillipson said the government would announce “major reforms” to long-term investment in universities in the coming months.

He said the government must “take the tough decisions needed to make universities stronger”.

But he told the BBC he would also “demand more universities”, and look at things like the value of top bosses, to “drive better value for students and for taxpayers”.

Prime Minister Keir Starmer has said he wants to abolish tuition fees altogether when he becomes Labor leader in 2020.

But by 2023, he said Labor was “likely to move forward” on that promise. In this year’s general election campaign, he confirmed he would do so because he wanted to prioritize spending on the NHS.

In the Commons on Friday, Conservative shadow education secretary Laura Trott called the increase in tuition fees “an increase in the effective tax graduates have to pay”.

Next year, tuition fees and maintenance loans will be linked to a measure of inflation called the RPIX, which accounts for everything except mortgage interest costs.

It is currently set at 3.1%.

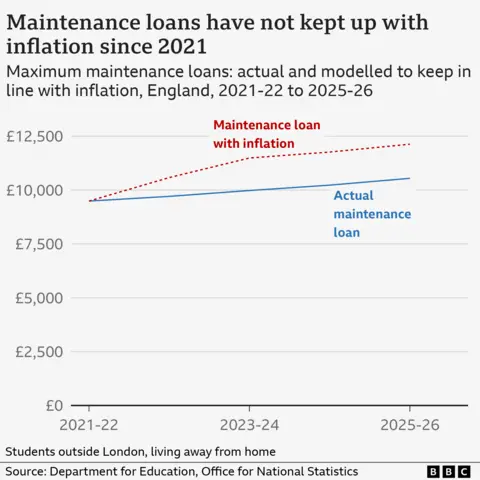

This will increase the maintenance loan cap from £10,227 to £10,544 for students living outside London, and from £13,348 to £13,762 in London.

The maintenance grant, which cannot be paid, was canceled in 2016.

In an analysis of the changes, the Institute for Fiscal Studies (IFS) said that the increase in tuition fees would save universities from reducing teaching resources.

But he called on the government to say that fees would continue to rise after next year, “to give certainty to universities and prospective students”.

He also said that, under current repayment terms, about a quarter of the extended loan would eventually be written off and paid by taxpayers.

Although students taking out the highest maintenance loans will have more money next year, the IFS says they will still be borrowing 9% less than they would in 2020/21.

The changes announced on Monday will affect students starting university next year, but also current students – although universities may have contracts that protect students from fee increases during their course.

Students Shay and Zay, both in their first year studying product design at Manchester Metropolitan University, said the higher fees could discourage prospective students.

Branwen Jeffreys/BBC

Branwen Jeffreys/BBCZay said the cost of college “has been a huge factor that plays into a lot of people’s minds” when deciding whether to go to college.

Shay said the university “is already as expensive as it is,” but added that he is more concerned about whether maintenance money can cover living expenses.

Personal finance expert Martin Lewis said the change in tuition fees was “likely to be insignificant”, especially compared to students starting university in 2023.

Last year, the loan term increased from 30 to 40 years and the repayment threshold salary fell from £27,295 to £25,000, meaning more graduates will be repaying their loans.

Tom Allingham, of the money advice website Save the Student, said that despite the “concern” over the increase in fees, it would make “little difference to the overall level of student debt, and would have no impact whatsoever on the amount graduates pay each month” .

That sentiment is mirrored by former sixth formers at Oldham considering their university options for next year.

Niamh, who wants to study English literature, said tuition fees had not risen by a “huge amount”, but an increase in maintenance loans was “definitely needed” to support students.

He said the fees for university students were “ridiculous”, so “even a little extra support is welcome”.

James, who wants to study engineering, said it was “unfair” that he had to work to finance university living costs, despite mounting maintenance debts.

Hope Rhodes / BBC

Hope Rhodes / BBCSarah Coles, head of personal finance at Hargreaves Lansdown, a financial services firm, says parents of young children should save now for their university years.

He advises parents of older children to be “clear about the level of financial support they can expect from you”.

Vivienne Stern, chief executive of Universities UK, which represents 141 universities, said the government’s decision to change tuition fees was the “right thing to do”.

He said the freeze was “unsustainable for students and the university”.

But Jo Grady, general secretary of the Universities and College Union, said raising tuition fees was “economically and morally wrong” and that the government was “taking more money from student borrowers” to support universities.

The changes come after concerns about the finances of universities in the UK.

The Office for Students, the regulator of higher education in England, warns that 40% of universities have predicted a deficit this academic year.

In July, Phillipson said universities have to “manage a budget” amid calls for the government to save the struggling institution.

UK universities have previously advised tuition fees should rise to £12,500 per year to meet the cost of teaching.

But he also admitted that asking for that amount would appear “ignorant” and “out of touch”.

The government hopes that increasing maintenance support will help students with daily living expenses like food and accommodation.

But higher tuition fees and higher maintenance loans mean students have to borrow more to get to university, and will leave with more debt.

The Department of Education will publish an impact assessment soon, along with legislation governing the changes. It will look at the impact of changes in student loans at graduation, and their repayments over time.

A tripling of costs in the UK in 2012 is expected widespread protests.

Since then, they have only increased once, in October 2017, when prime minister Theresa May announced a £250 increase.