At S&P 500 setting one new all-time high after another in 2024. The widely used stock market benchmark is up 15% in the first half of 2024, and is up more than 50% from the bottom of the 2022 bear market.

The largest companies have led today’s market rally in the S&P 500. In fact, market concentration has reached levels not seen by investors since the 1970s.

Market concentration is increasing due to various factors. It is worth pointing out that many of the largest companies have seen solid earnings growth because they have been well positioned in the middle of the artificial intelligence boom. But concentration increases have historically been reversed, and one market indicator suggests the tide may be about to turn.

The US money supply is finally growing again

Declining growth in money sources has historically been linked to increased concentration among stocks, according to Khuram Chaudhry, Head of European Quantitative Strategist at JP Morgan. When money is easily accessible and cheap, small companies can grow more easily. When the money supply is tight, large companies have the advantage of using existing cash flow and balance sheets to finance growth.

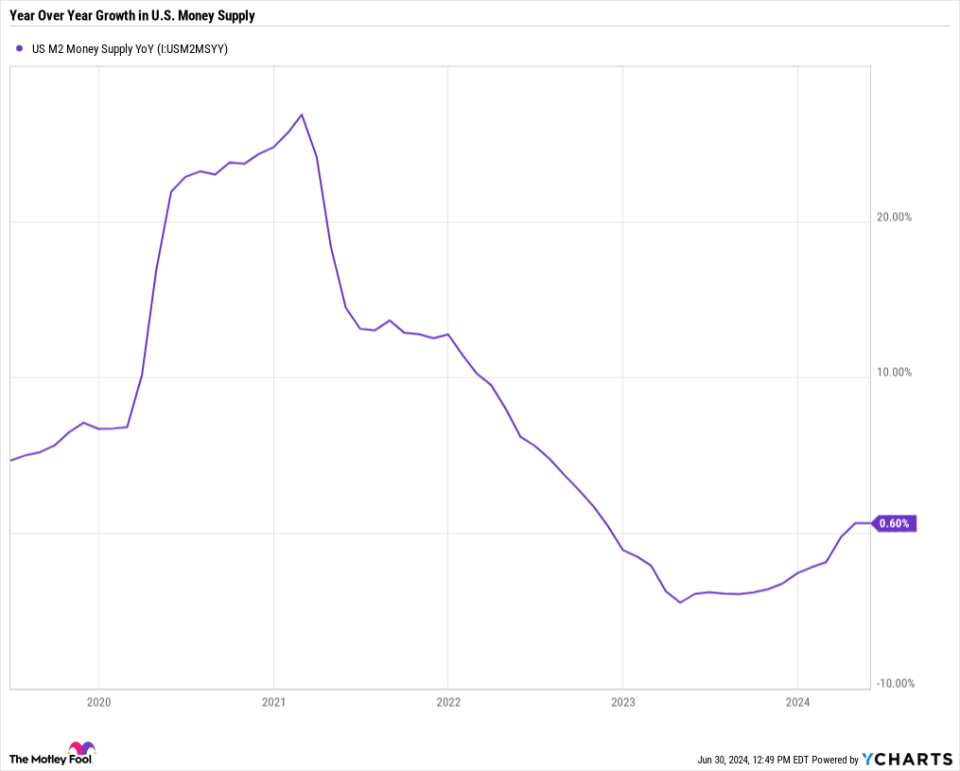

Starting in 2021, we see a decline in the measure of the US money supply called the M2 money supply. M2 includes cash in circulation, deposit accounts, money market accounts, and certificates of deposit. Basically all the money that is easily accessible in the country. In 2022, amid tightening policy from the Federal Reserve, year-over-year growth in money supply M2 was negative. It remained the same in the first quarter of this year.

But the M2 money supply eventually grew again. In April and May, the M2 money supply increased by about 0.6% year-on-year. While still below peak levels from 2022, we are finally seeing increased liquidity.

The money supply could increase again later this year, as the Fed looks to overcome constraints. Chairman Jerome Powell has said he expects to cut interest rates once this year, but many analysts are conservative. Futures markets indicate that the majority of traders now expect at least two interest rate cuts later this year.

As the growth of money supply accelerates, it can make it easier for small companies to grow. As a result, these smaller companies may be leading the next leg of the current market rally.

How to invest as a source of money growth accelerates

If you expect the easing of fiscal policy to reverse the steep rise in market concentration, there are several ways you can invest.

The easiest way to invest in a declining market concentration is to use an equally weighted index fund Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP).

The S&P 500 is a cap-weighted index, meaning that the largest companies have a greater influence on how the index moves than smaller companies. With the current level of market concentration, the top three companies account for more than 20% of all index values. The top 10 accounts for more than 37%. If you invest in a standard S&P 500 index fund, your portfolio is heavily dependent on a number of companies.

With an equal-weight S&P 500 index fund, the fund invests all of your money equally in each component of the S&P 500. The portfolio is rebalanced every quarter and adjusted for new companies joining the S&P 500 and old companies leaving. Historically, equal-weighted indexes have outperformed cap-weighted indexes, because smaller companies generally grow faster than the largest companies. That hasn’t happened recently.

Another option is to invest outside the S&P 500. There are thousands of stocks you can invest in on the public exchange. The S&P 500 tracks only about the 500 largest companies. Declining market concentration will favor small and mid-cap stocks as well. Buy shares from a Russell 2000 index funds as in iShares Russell 2000 ETF (NYSEMKT: IWM) it’s a good way to get exposure to small-caps. At Vanguard Extended Market ETF (NYSEMKT: VXF) provides a way to match the performance of almost every stock in the market except for those in the S&P 500.

While there are no true indicators, the growth of cash flow is not the only factor that suggests now may be the best time to start investing in small companies. So, you may want to tilt your portfolio towards investments like those mentioned above as other signs point to big changes in the stock market.

Should you invest $1,000 in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF right now?

You can buy or sell shares of the Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF on the NYQ stock exchange.

At Motley Fool Stock Advisor The team of analysts only recognized what they believed it to be 10 best stocks for investors to buy now… and the Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF is not one of them. 10 stocks that made the cut could produce monster returns in the coming years.

Try when Nvidia created this list on April 15, 2005… if you invest $1,000 when you recommend, you would have $751,670!*

Stock Advisor gives investors an easy-to-follow blueprint for success, including portfolio-building guidance, regular updates from analysts, and two new stock picks every month. At Stock Advisor service already more than four return of the S&P 500 since 2002*.

View 10 stocks »

* The Stock Advisor returns on July 2, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has no position in any of the stocks mentioned. The Motley Fool has a position on and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.

US Money Supply Finally Growing Again, and Could Sign Big Changes Coming to Stock Markets originally published by The Motley Fool