Raspberry Pi shares on Tuesday rose 31% in morning trade, as the British computing startup seeks to raise some £166 million ($211.2 million) from an initial public offering.

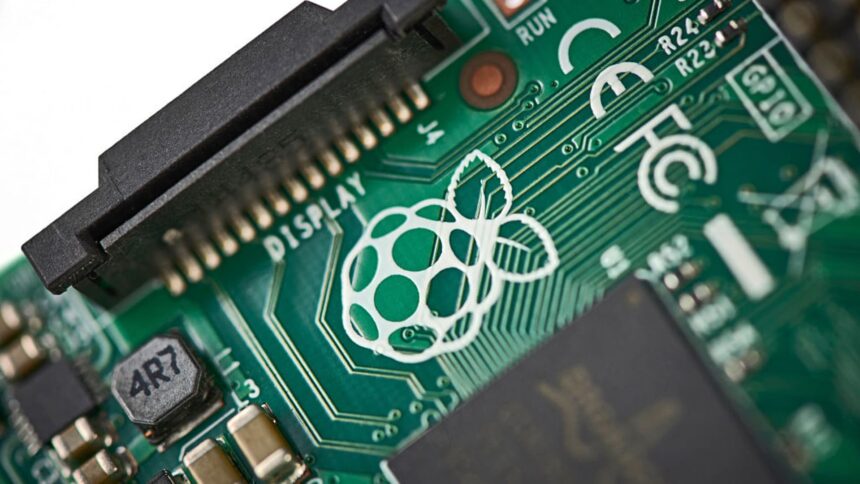

Raspberry Pi shares began a “conditional deal” on Tuesday with full open trading due to start on Friday. Shares rose to 390 pence after the company, which makes small single-board computers, valued its shares at 280 pence each. The listing is seen as a rare win for London’s main stock exchange which has struggled to attract tech listings.

Based on the initial share price, the company is worth around £541.6 million.

The Raspberry Pi offering consists of 45.9 million ordinary shares sold by the company’s existing majority shareholder, Raspberry Pi Mid Co Limited, a subsidiary of the Raspberry Pi Foundation. It also includes 2.13 million common shares sold by other shareholders, along with 11.23 million newly issued shares.

If there is more demand, the so-called overallotment option will allow the Raspberry Pi Foundation to issue another 4.6 million shares. If the overall option is exercised, the size of the final offer will be £178.9 million.

Raspberry CEO Eben Upton founded the company in 2012 to make computing more accessible to young people. A single board computer can be used for many different uses.

While initially gaining traction with enthusiasts, the company says that 72% of unit sales target the industrial market, which is used, for example, in factories.

In 2023, Raspberry Pi generated revenue of $265.8 million, up 41% annually from 2022.

Several prominent industry players are backing the company, including Arm and Sony. Last year, Sony Semiconductor Solutions, a subsidiary of Sony Corporation, invested an undisclosed amount in the UK startup.

While relatively small to other technology companies, the Raspberry Pi IPO can breathe life into the struggling London bourse, which has been snubbed by technology companies in favor of listing in other regions of Europe, and especially in the US.

UK-headquartered chip designer Softbank Arm opted to list in the US last year.