The future of Southeast Asia’s booming solar industry, which produces the most panels in the world after China, is in doubt as the US looks set to impose hefty tariffs on the region.

Content of the article

(Bloomberg) — The future of Southeast Asia’s booming solar industry, which produces the world’s most panels after China, is in doubt as the U.S. looks set to impose hefty tariffs on the region.

Chinese companies that have set up factories there for the past decade are now accused of levying tariffs on US imports in their home markets. At least three – including Longi Green Energy Technology Co. and Trina Solar Co. – has reduced operations in Thailand, Vietnam and Malaysia, which, along with Cambodia, are targeted by Washington.

Advertising 2

Content of the article

Those four countries account for more than 40% of solar module production capacity outside China, according to BloombergNEF, and other Chinese companies with facilities there are vying for the market to replace the US.

“The mood for suppliers is to pack up their lines, especially cell lines, and move to Indonesia, Laos or the Middle East,” said Yana Hryshko, head of global solar supply chain research at Wood Mackenzie Ltd. Some are Chinese. manufacturers are waiting to see what the tariff level will be before deciding whether they should move, she said.

The uncertainty underscores wider turmoil in the clean energy supply chain as the US, Europe and others seek to wrest some market share from China, which dominates production of solar equipment as well as electric vehicle batteries. Chinese solar companies are also struggling with a growing domestic surplus that some smaller players have seen.

A US investigation last August concluded that some Chinese manufacturers – which initially invested in Southeast Asia after the US imposed tariffs on panels imported directly from China in 2012 – illegally bypassed the levy. The decision resulted in import taxes of various levels being imposed on five companies in the region.

Content of the article

Advertising 3

Content of the article

Some US companies are now asking Washington for tariffs of more than 272% for all solar products from the four countries, although BNEF said in May they would likely be between 30% and 50%. This compares to China’s 25% levy, which the White House plans to double.

Washington came close to imposing tariffs in June, with the US International Trade Commission passing a preliminary vote that determined that manufacturers were being harmed by cheap imports from Southeast Asia.

Since then, Chinese and Malaysian publications have reported that Longi has shut down five production lines in Vietnam and is beginning to end operations in Malaysia, Trina plans to close some capacity in the region, and Jinko Solar Co. closing down factories in Malaysia.

A Longi spokesman said in June that it had made adjustments to production plans at some factories, partly because of changes in trade policy. The company said in a subsequent exchange filing that its plant in Malaysia still ships cells to the US, and has no plans to move capacity because demand from other markets including India and Canada will be sufficient to support its Southeast Asian plant.

Advertising 4

Content of the article

Trina’s cell plant in Thailand is still operating normally, and it will decide what to do at the Southeast Asian facility depending on the results of the latest US trials, it said in a statement. Jinko did not respond to requests for comment, while JA Solar Co said its factory in Vietnam was operating normally.

Not all Chinese factories in Southeast Asia will be closed, as products from there can be shipped to India, Europe and elsewhere, according to Dennis Ip, an analyst at Daiwa Capital Markets. Some older facilities may close, but newer plants should survive if they can find alternative markets, he said.

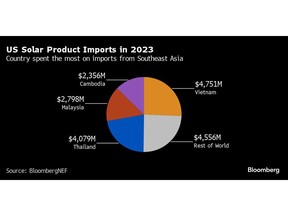

The tougher line from the US comes as the two main political parties there take a tougher stance against Beijing in the run-up to elections in November. As well as jeopardizing Southeast Asian production, it could jeopardize Washington’s decarbonisation efforts, as more than three-quarters of solar product imports came from the region last year.

While the tariffs will be implemented as early as next year, it may be sooner if there is an electoral advantage for Democrats, said Deborah Elms, head of trade policy at the Hinrich Foundation, an Asia-based nonprofit that works on the issue. to advance sustainable global trade. However, U.S. solar manufacturing is not moving as quickly as expected, which means there may be less oversight, he said.

Efforts to limit US restrictions on Chinese imports will continue, and this is especially true if Donald Trump is elected, Elms said. He is “very focused” on countries where the US has a trade deficit, and that includes many Southeast Asian countries, he said.

Content of the article