Russian President Vladimir Putin has stepped up Western efforts to isolate him internationally, meeting with more than 20 world leaders since May. Russian business is not so lucky.

Content of the article

(Bloomberg) — Russian President Vladimir Putin bucked Western efforts to isolate him internationally, meeting with more than 20 world leaders since May. Russian business is not so lucky.

New US restrictions imposed in June to curb support for the Kremlin’s war in Ukraine have put local banks in countries that trade with Russia at higher risk of so-called secondary penalties, increasingly delaying or disrupting payments to and from destinations like China and Turkey. That makes it difficult, and sometimes impossible, to conduct transactions, especially with China, perhaps Russia’s most important economic partner from the start of the 2022 war.

Advertising 2

Content of the article

While the problem of transferring profits from another major trading partner, India, has decreased since the first years of the war, it has not been completely resolved because the rupee is not fully convertible and transactions even with third countries are expensive, close people. to the Russian government, declining to be identified because the information is not public.

The difficulties have threatened to disrupt Russia’s trade with economic partners it relies on since the European Union and the US imposed unprecedented sanctions that strained business ties after the invasion of Ukraine. Trade with China will reach a record $240 billion by 2023.

In June, the US expanded the parameters for determining whether to impose secondary sanctions by broadening the definition of Russian military-industrial bases. Imports to Russia from China have begun to grow again after the volume collapsed when the US first threatened overseas banks with fines in December, but the latest move threatens to complicate the situation.

In many cases, transactions with China can only be done through agents in the former Soviet republic, said top executives at four commodity exporters, declining to be identified as sensitive information. For the offer, foreign currency, including the yuan, will not reach Russia. When Chinese clients pay yuan to agents in third countries, exporters often receive rubles in Moscow, the person familiar said, noting many intermediary countries have their own restrictions on currency movements.

Content of the article

Advertising 3

Content of the article

Cryptocurrency settlements through Hong Kong are also becoming more popular, but even in these cases, Russia is forced to use intermediaries in countries like Uzbekistan or Kazakhstan, said two exporters and people involved in crypto payments. Russian companies have even tried to use barter or currency exchange deals with importers at the same banks, the three people said.

Of course, some exporters said they had no problems making payments, and at least one major energy exporter said yuan-denominated transactions from China this month went smoothly.

While payments with China are the biggest problem for Moscow, Russians are facing similar difficulties in Turkey, people familiar with the matter said. The situation there is less complicated because only a few banks have stopped operating with Russia, he said. Trade with Turkey also usually takes place in rubles, the people said. The share of Turkish exports in rubles increased by 50% from January to May, state statistics show.

Rupee Account

With India, the pressure on banks from the threat of sanctions is complicated by the fact that the rupee is not fully convertible. As trade between the countries jumped after Russia invaded Ukraine, Russia amassed billions of dollars in Indian rupees.

Advertising 4

Content of the article

To enable Russia to use the accumulated rupees, the Reserve Bank of India made a rule in July 2022 that said funds can be invested in Indian projects or securities, as well as set the purchase of goods and services in the future, he said. officials immediately saw the details. Russia usually buys smartphones and other electronic goods, chemicals and medicines, food products, agricultural tools and textiles from India.

The RBI insisted that the investment would be subject to guidelines and restrictions, indicating that it was unwilling to carve out special rules for Russia. Senior Indian officials have repeatedly reiterated that India will do nothing to violate Western sanctions. The investment is also subject to a lock-in period and cannot be transferred, making it difficult for Russia to remove it, people familiar with the rules said.

Following the clarification, the RBI approved at least 34 applications from Russian banks to open accounts in India, and at least nine special “vostro” accounts were opened to facilitate trade.

Advertising 5

Content of the article

Oil, Russia’s main export to India, is generally paid for in United Arab Emirates dirhams, which are pegged to the US dollar. Still, dollars and euros are also used, according to people in the know. The people said some private refiners also use yuan. Fertilizer makers and Russian coal producers also prefer convertible currencies and do not trade in the rupee, executives at several companies said.

Russian state-controlled diamond miner Alrosa PJSC declined to comment on the currency used for its operations in India, and state arms exporter Rosoboronexport did not immediately respond. Trade with India is often done through intermediary countries such as the UAE and in currencies other than the rupee, which makes trade expensive, people close to the Russian government said.

‘Main Challenge’

“The issue of cross-border payments in 2024 has become a major challenge for Russian businesses,” said Alexander Potavin, a Finam analyst in Moscow. “In most cases, businesses face significant delays in payment. Currently, the average is around 10-16 days.

Advertising 6

Content of the article

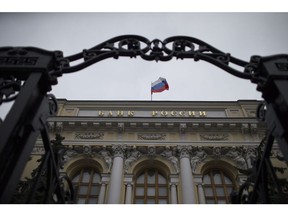

Potavin said that the Bank of Russia “now encourages the use of cryptocurrency” to bypass Western sanctions and facilitate currency transfers abroad.

The payment issue was at the top of the agenda when Putin recently met with Chinese President Xi Jinping, Turkish President Recep Tayyip Erdogan and Indian Prime Minister Narendra Modi. While Russia has made proposals to develop alternative payment methods, it will take time for them to get up and running.

The effect of all this has not been reflected in statistics on exports and imports, but the report on the economic situation in the second quarter of the Russian central bank published on July 18 highlights the problem. Imports fell in the second quarter, according to the report, and while the total value of exports rose, physical volumes fell due to Western restrictions on Russian metals, the report said.

“Difficulties in payments between countries make the situation worse, especially with imports,” said Natalya Zubarevich, a specialist in the Russian region at Moscow State University. “The consumer market in Russia is getting worse, and it will get worse,” while component imports will gradually deteriorate, he said.

“You have to do everything so that the wheels can turn,” even methods that previously seemed unpopular – like swaps or the use of crypto, First Deputy Governor of the Central Bank of Russia Vladimir Chistyukhin said at a forum in June.

Without “normal payments” for goods, “it means death for countries that depend on exports and imports,” he said.

—With help from Anup Roy.

Content of the article