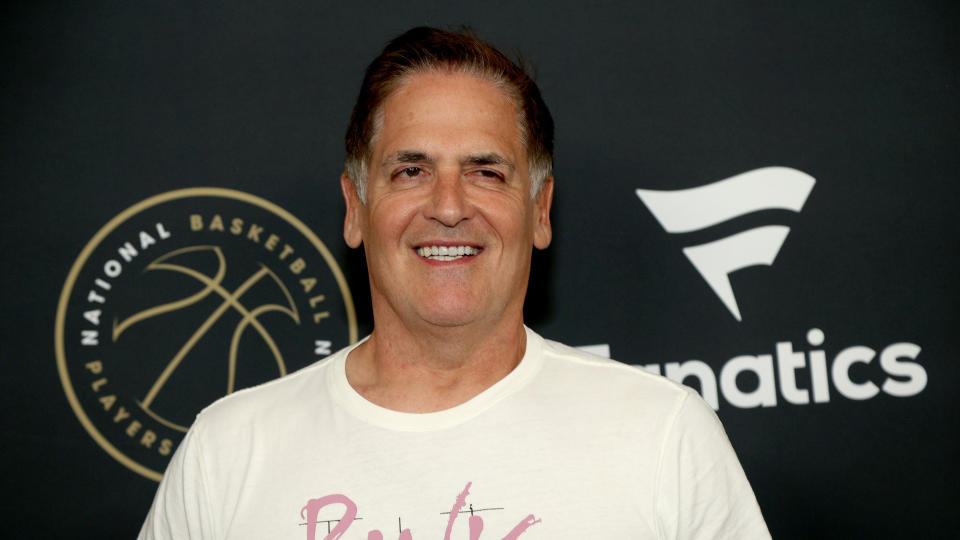

Mark Cuban, entrepreneur and part owner of the Dallas Mavericks, said in a Wall Street Journal interview that he doesn’t believe the common investment advice that portfolio diversification is a good approach for the average investor. Here’s what to say and the upsides and downsides of the approach.

Learn more: Mark Cuban’s Best Advice on How to Get Rich

Read Next: 7 Reasons Financial Advisors Can Increase Your Wealth in 2024

Earning passive income doesn’t have to be difficult. You can start this week.

Mark Cuban on Diversification and ‘Buy and Hold’

Many financial advisors recommend that you diversify your portfolio to reduce risk. This means dividing your money into different investments that usually don’t go up and down at the same time. That way, you won’t lose all your money if one of your investments fails spectacularly.

One of the most diversified ways to invest in the stock market is to buy an index fund that tracks a variety of companies, such as the S&P 500. The theory is that if you invest in a large part of the market at once, one company’s failure won’t affect you much.

Cuba disagreed. He told an interview with Alan Murray, “Diversification, that’s for fools.” He says that ordinary investors don’t have the knowledge or resources that large hedge funds have and don’t have the time to understand many different investments. Because of this, he recommends focusing on a few investments and learning about them.

Cuban also expressed skepticism about the general “buy and hold” approach. Until you decide to invest, he advises you to keep your money in cash.

Check Out: 5 Ways To Pick Your Next Investment, According To The Experts

Trade Risks

So, what are the upsides and downsides of the Cuban approach? The advantage of focusing on only a few investments is that if you are successful in your research and time and the investment you choose grows, you can generate more. Your money will not be spread over many other investments, so you can take maximum advantage of the growth.

However, doing this correctly is not easy, and may require a bit of luck. If you are not buying and holding long-term investments, then you are, by definition, trading. When you trade stocks or other investment vehicles, there are some additional risks to consider.

Markets can go up and down unpredictably, and trying to time the market can result in big losses. Even if you know your investments inside and out, government intervention or unexpected factors can change the playing field.

A Buy and Hold Approach

The advantage of buying and holding is that most markets increase in value over time. Even if you time the entry badly and the investment loses value after you buy, as long as you don’t sell, you should get your money back – and more – with time.

Of course, this applies to the market, not the individual companies within it. The S&P 500 index recovered from the 2000 dot-com bubble in about seven years, for example, but many of the individual companies that crashed never recovered.

Warren Buffett’s Opinion on Diversification

Warren Buffett, one of the most successful investors in history, actually agrees with Cuba, although he recommends diversification for the average investor. Buffett once said, “Diversification is the protection against ignorance. It’s useless if you know what you’re doing.”

This means that for investors who are not experts in analyzing individual companies, spreading investments across multiple assets reduces the risk of significant losses if one of the investments performs well. Buffett believes that most people don’t have the time or expertise to carefully evaluate every investment opportunity, so diversification is a good option for them.

However, if you know what you’re doing, then carefully choosing investments that are less likely to pay off.

Buffett often recommends that average investors put their money into low-cost index funds that track the broader market. However, the hedge fund, Berkshire Hathaway, makes significant investments in individual companies, such as Apple and Coca-Cola.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Mark Cuban’s Surprising Advice for Diversifying Beyond the Stock Market