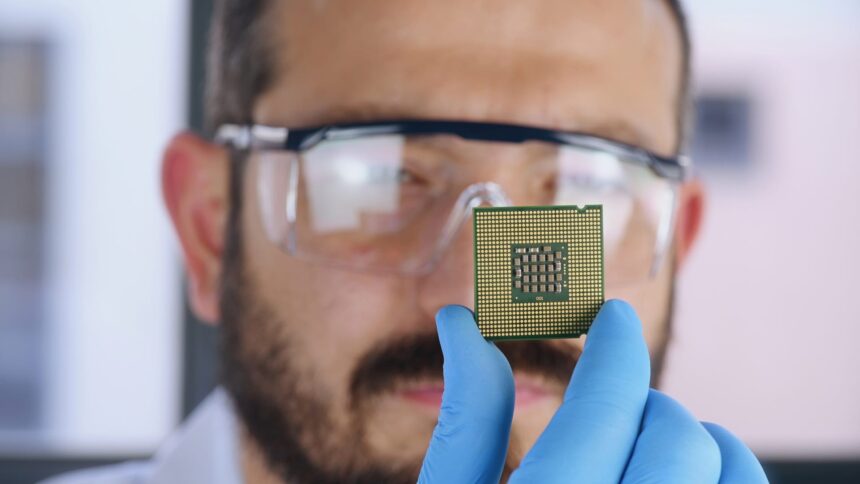

The global chip maker is focused on the middle of a boom in artificial intelligence applications.

Sefa Ozel E+ | Getty Images

Global chip stocks rallied on Thursday after US memory semiconductor makers Micron revenue guidance delivered the highest expectations and boost the stock price.

Micron forecast revenue for the last quarter at the end of November of $8.7 billion, plus or minus $200 million, ahead of the estimate of $8.28 billion, according to LSEG data.

Micron shares closed up 15% in the US on Thursday.

Bigger rivals Samsung Electronics and SK Hynix both saw their shares rise Thursday in South Korea. Samsung closed over 4% higher while SK Hynix ended up over 9%.

SK Hynix made the announcement on Thursday after the company said it has started mass production of a new version of its high-bandwidth memory (HBM) chip and aims to ship it by the end of the year.

SK Hynix and Micron are two suppliers of memory chips NvidiaProducts designed for artificial intelligence processes in the data center. HBM chips appear to be the key to AI.

Micron’s earnings highlighted that demand for data center chips remains strong as investors look for signs that the rally in AI-related stocks will continue. Micron confirmed that its HBM chips are already sold for 2024 and 2025.

In Japan, stocks of Tokyo Electron jump 8%. Part of this increase was fueled by comments from the company’s CFO to the Nikkei that saw AI-related sales rise about 15% in the current fiscal year to 690 billion yen ($4.8 billion).

SoftBank Groupwhich is the majority owner of chip designer Arm, up more than 4%.

Optimism about Asian chip stocks filtered through to Europe.

Dutch semiconductor equipment manufacturer ASML rose more than 4% in early trade in Europe. Other names included ASMI, So Semiconductor and STMicro is also very high.