Nearly 40 years after India GCC poster boy, Texas Instruments, made Bengaluru home for R & D operations, Indian GCCs have created a compelling story for global companies to acknowledge India’s enviable tech talent pool. This has, a) created more tech jobs in India; and b) strengthening India’s position as a center of advanced technological development.

6 lakh new jobs in 5 years

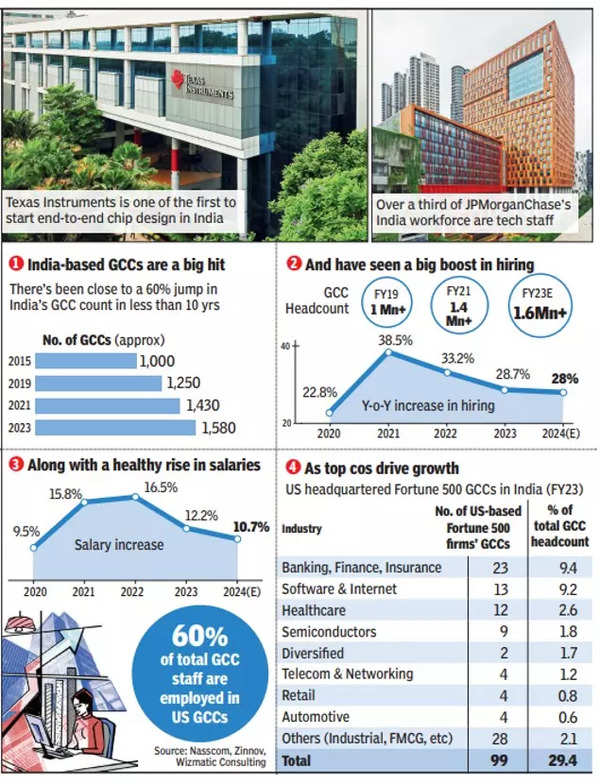

Consider the numbers: India currently has around 1,600 GCCs. This is expected to rise to 1,900 next year. According to the Nasscom-KPMG report, the combined market size is now $60 billion. In 2014-15, it was $19.6 billion, which will more than double to $46 billion in 2022-23, a compound annual growth rate (CAGR) of 11.4%. The GCC added more than 6 lakh new jobs between 2018-19 and 2023-24, with a total employment of more than 16 lakh or 1.6 million.

If this sounds good, here is some more good news for the sector. The latest Economic Survey is optimistic about the future of the GCC. By 2030, the Survey projects, the GCC will contribute a total revenue of $121 billion – about 3.5% of India’s current GDP. Of this amount, $102 billion will come from exports.

Take JPMorgan Chasefor example. Headcount in India increased to over 55,000 from 34,000 in 2018. Deepak Mangla, CEO, corporate center, India, and Philippines at JPMorganChase, in a recent interaction with TOI, said that the India operation is a microcosm of all business lines and functions, not only technology. “We consider ourselves a technology-driven bank. I have a very good strategy for talent distributed across the globe. We have more than 60,000 technologists in the company and about one-third of them are in India. Center Indian companies in particular employ 55,000 people, of which about 20,000 are in technology.”

Gunjan Samtani, COO of global engineering at Goldman Sachs and country head of Goldman Sachs Services India, said that more than 120 global functions in business and engineering are carried out from GCC India in Bengaluru and Hyderabad, which employs 8,500 people. “Over the last two decades, the functions performed from India have evolved from end-of-day support for trading platforms and exchange connectivity to algo trading platform support, data analytics, and client reporting. Today, GCC India is a center of excellence with thought leadership for several equity engineering function,” he said.

Innovation hub

GCCs in India have emerged as a playbook for innovation hubs. India’s Texas Instruments (TI), for example, was one of the first players to enable end-to-end chip design in the country. “TI engineers play a key role in the entire chip design process, from concept to design, product engineering, testing and validation, and system software… Some of the best teams in the industry for product development are at TI India,” said Santhosh Kumar, TI president and managing director.

Goldman Sachs’ India Center has developed Atlas, a low-latency trading platform that hosts a complete trading strategy to help clients achieve trading goals, perform historical analysis, build quantitative models with real-time market information, and execute trades. “This platform helps cut microseconds in trade execution for clients (low latency trading). Latency reduction from this platform helps us engage with existing and newer hedge funds and the number of clients,” said Samtani.

Recently, GE Aerospace CEO Larry Culp told TOI that the company’s 1,200 engineers at the John F Welch Technology Center in Bengaluru are engaged in cutting-edge work on the future of aviation – including the Leap engine for narrow-body aircraft, the GEnx in wide-body space, and the next-generation Rise platform for the market narrow body. The company also announced an investment of over Rs 240 crore to expand and upgrade its manufacturing facility in Pune. The plant has produced components supplied to GE’s global factories, which are used to assemble engines such as the G90, GEnx, GE9X, the world’s most powerful commercial jet engine, and the Leap engine by CFM, a joint venture between GE and Safran.

Move up the value chain

Sangeeta Gupta, senior VP and chief strategy officer at Nasscom, said India will continue to be central growth GCCs, make a significant impact in economic, human capital, innovation, social, and environmental dimensions. “Talent will be a key driver of this growth, with new and established centers adding capacity. There is a significant shift towards integrating enterprise functions, analytics, and AI, with tasks focused more on enterprise functions, product management, decision support, and capabilities embedded system.”

Gupta added: “GCCs are increasingly important for parent companies, focusing on moving up the value chain, creating opportunities for future leadership, and increasing overall impact.”

Ramkumar Ramamoorthy, partner at technology growth advisory firm Catalncs, said, “With several hundred GCCs reaching critical size, I expect employment numbers to accelerate from here. I would not be surprised if the GCC headcount crosses 4 million in India in the next five. Another big impact what GCC does today is technology transfer through R&D, and knowledge in newer areas such as product development and management, AI, cyber engineering, edge computing, synthetic biology, etc. and today’s IITs offer advanced programs in product management as the case.

While the boundaries between technology and traditional industries are blurring, the GCC is becoming a talent hotspot in newer areas such as full-stack development, AI, IoT, embedded systems, and automation, shaping the global market. “GCCs are established nurturing advanced skills beyond pure technology, including product management and architecture, where they build deep domain expertise. This shift enables them to deliver higher value works and gain a more complete understanding of the business context,” said Pari Natarajan, CEO from global management consultancy Zinnov. The study shows that the number of global roles in the GCC in India is expected to grow from just 115 in 2015 to 30,000 in 2030.

A better salary

Lalit Ahuja, founder of Bengaluru and US-based ANSR, which has set up more than 120 GCCs, says GCCs have emerged as good paymasters, outperforming their IT services peers in several roles within the company. About 100 Indian GCCs have top leaders who get compensation of nearly $1 million, which includes cash and stock awards, Ahuja added. These roles include site leaders based in India and senior VPs leading technology functions.

Arindam Sen, EY India Global Business Services & Operations partner, said that roles like CIO, CTO, chief financial officer, chief procurement officer will increase in India. “People from the center grow into the organization and assume that role. Either the role itself or someone selected from the center is part of the talent strategy that eventually takes that role.”