What’s better than paying dividends every quarter? How about getting a monthly salary? This is the main financial indicator of the NEOS S&P 500 High Income ETF.BATS: SPYI) has to offer investors, and it also generates huge dividends.

I am convinced about this new monthly dividend ETF from NEOS based on this attractive payment schedule and its trailing dividend yield of 11.6%, which is an incredible nine times higher than the yield of the S&P 500 (SPX).

What is the SPYI ETF Strategy?

According to the NEOS fund sponsor, SPYI “seeks to distribute high monthly income from investing in the constituents of the S&P 500 Index and implements a data call option strategy.”

The fund “uses a call option strategy that may include both sold and purchased SPX index options, which may provide an opportunity to catch the upside in a rising equity market.”

Essentially, SPYI owns shares in the S&P 500. It then generates monthly income for its holders through dividend payments from those shares and by selling call options on the S&P 500 to generate additional income through premiums from those options contracts.

While this generates a high monthly income, investors should also note that using this strategy, they may sacrifice some degree of increase from capital appreciation. If SPYI’s holding rises above the strike price for the guaranteed call contract it sells to generate this income, SPYI will forgo this additional increase.

You can see this dynamic play out by looking at ETF results. For example, in 2023, SPYI generated a total return (which includes price appreciation and dividends) of 18.1% for the year. While this is a strong return, the S&P 500 underperformed by 26.3% for the year.

However, there is one thing that SPYI does a little differently than other ETFs that use this covered call strategy. Instead of investing all the money received from selling call contracts, they have the option to reinvest some of the proceeds back into buying cheaper, more out of the money call options, in order to participate in some of this upside if they hold the base. exceeding the strike price.

As NEOS explains in the fund’s summary prospectus, the fund seeks to use S&P 500 call options “to generate net-credit, meaning the premium received from selling call options will be greater than the cost of buying long, out-of-the-money SPX call options.”

Incredible Dividends

While the strategy is complex and has some pros and cons in terms of capital appreciation and total return, there is no denying that it is a powerful way to generate significant income. This is evidenced by SPYI’s 11.6% dividend yield, about nine times higher than the S&P 500 (currently yielding only 1.3%).

Not only that, but the SPYI yield is easily more than twice the 4.35% yield by the 10-year treasury bond, making SPYI a compelling income investment no matter what type of interest rate environment we find ourselves in.

ETFs employing this strategy have grown in popularity in recent years, and it is worth noting that SPYI also features more returns than many of these. For example, the JPMorgan Equity Premium Income ETFNYSEARCA: JEPI), the largest and best-known of these ETFs, has a 7.4% yield, and the JPMorgan Nasdaq Equity Premium ETF (NASDAQ: JEPQ) yields 8.8%. This is an impressive result, but SPYI is higher.

It is important to note that the SPYI dividend payment rate is not set in stone, and the amount may vary from month to month. However, these payments have been relatively consistent, ranging between $0.47 and $0.50 per month over the past year. In addition, since its launch in August 2022, SPYI has been paying monthly distributions, thus starting to build a strong record of monthly dividend payments.

SPYI’s Holdings

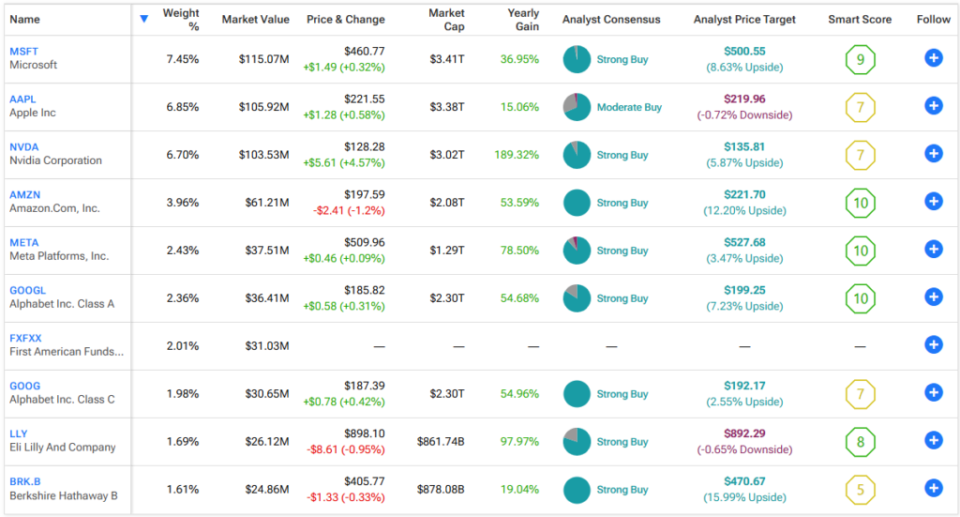

SPYI offers strong diversification, with 508 holdings. The top 10 holdings make up 38% of the fund’s equity. Below, you’ll find a summary of SPYI’s top 10 holdings using the TipRanks holdings tool.

Given the fund’s strategy of investing in the constituents of the S&P 500 index, its top holdings are unsurprisingly largely reflective of the broad market index. Its holdings include household names like Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ: AMZN), and Meta Platform (NASDAQ: META).

Steep Load Ratio

One negative aspect of SPYI is that it has a fairly high expense ratio of 0.68%. This means an investor in the fund will pay $68 for a $10,000 investment over the year. If the fund returns 5% annually and maintains its current expense ratio, this investor will pay $379 in fees over a five-year period, a pretty steep amount.

That said, this is a complex, actively managed ETF, so it’s understandable that the expense ratio is higher than a typical index fund. As long as the ETF continues to pay large dividends like clockwork every month, most holders will feel comfortable with an above-average expense ratio.

Is SPYI Stock a Buy, According to Analysts?

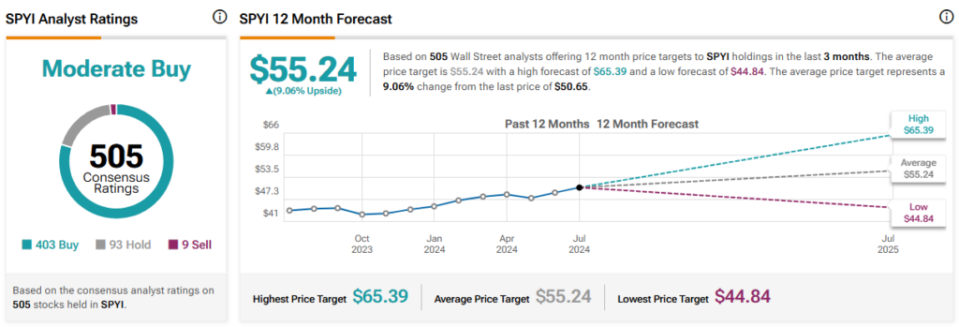

Turning to Wall Street, SPYI earned a Moderate Buy consensus rating based on 403 Buys, 93 Holds, and nine Sell ratings assigned over the past three months. SPYI’s $55.24 average stock price target indicates a potential upside of 9.06% from current levels.

Takeaway: A Strong Choice for Income Investors

Investors should be aware that investing in ETF call options like SPYI can limit potential capital appreciation. However, with an incredible 11.6% return, there’s no need to fall in love with this ETF. I am bullish on SPYI as a good choice for income investors based on its attractive monthly payout schedule and massive 11.6% dividend yield. As part of a balanced portfolio, it is an effective tool to generate frequent, above-average income on a steady basis.

disclosure