District Super Micro Computer (NASDAQ: SMCI) has been one of the biggest winners of the artificial intelligence (AI) boom.

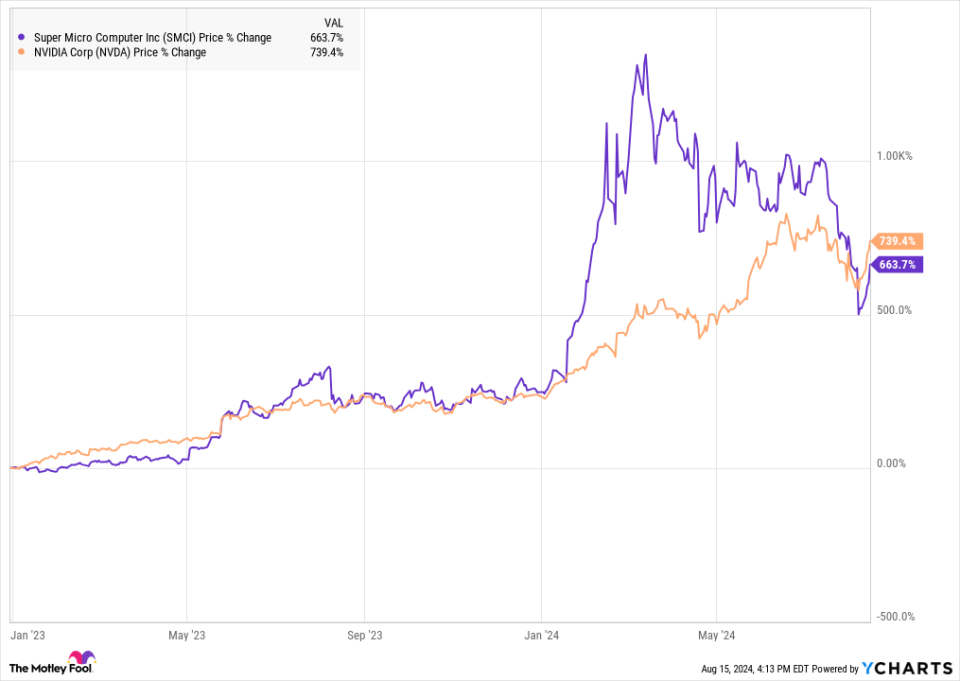

Even after pulling back in recent months, Supermicro, as the company is also known, is still up nearly 700% since the start of 2023, almost matching it. Nvidia as the chart below shows.

The company, which makes high-density servers ideally suited for running AI applications, has done so by putting up Nvidia-like growth numbers with revenue rising 144% in its recently reported fiscal fourth quarter.

In response to the stock surge, Supermicro recently decided to reward investors with a 10-for-1 stock split, which will take effect on October 1.

Did you buy Super Micro Computer before the stock split? Let’s look at the evidence.

Recent performance is mixed

There’s no question that Supermicro is experiencing soaring growth, but there are flaws in the company’s records, and that’s one of the reasons the stock fell after its recent earnings report. Gross margin has declined even as revenue has increased. In the fourth quarter, the company reported a gross margin of just 11.2%, down from 17% in the year-ago quarter. That translated into a lower operating margin for Supermicro as well, down to 6.5% from 10.3%.

The good news is that the company expects gross profit to recover, saying that supply chain bottlenecks have driven up prices for new components, but that should recede over the next year. Management also said that long-term gross profit will benefit from lower production costs in production in Malaysia and Taiwan. It also plans to expand in America and in Europe.

If margins recover next year, the stock should be higher.

Will a stock split help?

Investors should understand that a stock split does nothing to change the underlying value of the stock; it just divides the proverbial pie into more pieces, making individual shares cheaper.

There is also some evidence that stocks have outperformed S&P 500 in 12 months after the stock split, according to research from Bank of Americawhich found that stocks that split gain 25% on average compared to only 9% gain for S&P 500. This may be because stock splits tend to follow strong momentum in stock prices and affect management confidence in the business.

However, at least some evidence appears to contradict these findings. Nvidia, for example, the stock driving the AI boom and close partner Supermicro, issued a 10-to-1 stock split on June 7. Since then, the stock is up just 1.5%, slightly behind the S&P 500’s 3.5%.

Chipotle The stock peaked just before the 50-for-1 stock split on June 26 and has since fallen 21%.

Celsius HoldingsThe energy drink maker, down 20% since its 3-for-1 split last November, and Broadcomthe network chip specialist, down 3% since its 10-for-1 split on July 15, compared with a 0.5% decline for the S&P 500 over the same period.

Clearly, stock splits do not guarantee superior performance even though stock splits have outperformed their historical averages.

Should you buy a Supermicro before October 1st?

Whether you’re an AI stock investor or a stock split investor, the good news is that Supermicro’s pullback creates an attractive opportunity to buy the stock as it’s down nearly 50% from its peak in March when it was admitted to the S&P 500.

Super Micro Computer currently trades at a price-to-earnings ratio (P/E) of 31, which looks like a bargain for a stock that still has tons of growth potential and hopes to see margins expand over the coming years.

Supermicro has several competitive advantages that should help it continue to grow in the AI server market, including its close relationship with Nvidia and expertise with high-density servers. In addition, the company is a leader in direct liquid cooling (DLC), a key technology for optimizing hardware performance. CEO Charles Liang recently said, “We are targeting 25% to 30% of new global datacenter deployments to use DLC solutions in the next 12 months, with most deployments coming from Super Micro.”

The stock split alone isn’t a good reason to buy the stock, but with Supermicro’s strong growth prospects, attractive valuation, and greater long-term opportunity in AI, buying before the stock split looks like a good move.

Should you invest $1,000 in a Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

At Motley Fool Stock Advisor The team of analysts only recognized what they believed it to be 10 best stocks for investors to buy now… and Super Micro Computer is not one of them. 10 stocks that made the cut could produce monster returns in the coming years.

Try when Nvidia created this list on April 15, 2005… if you invest $1,000 when you recommend, you will have $758,227!*

Stock Advisor gives investors an easy-to-follow blueprint for success, including portfolio-building guidance, regular updates from analysts, and two new stock picks every month. At Stock Advisor service already more than four return of the S&P 500 since 2002*.

View 10 stocks »

* The Stock Advisor returns on August 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has positions in Bank of America, Broadcom, and Chipotle Mexican Grill. The Motley Fool has positions and recommends Bank of America, Celsius, Chipotle Mexican Grill, and Nvidia. The Motley Fool recommends Broadcom and recommends the following option: short September 2024 $52 put on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Did You Buy a Super Micro Computer Before the Stock Split? this was originally published by The Motley Fool