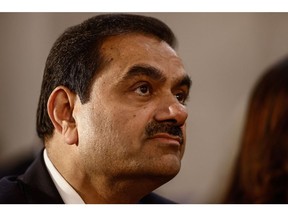

Battle lines are being drawn in India’s cement space as Gautam Adani’s expansion begins a race with billionaire Kumar Mangalam Birla’s UltraTech Cement Ltd. to build capacity and acquire assets.

Content of the article

(Bloomberg) — Battle lines are being drawn in India’s cement space as expansionist Gautam Adani begins a race with billionaire Kumar Mangalam Birla’s UltraTech Cement Ltd. to build capacity and acquire assets.

The clash of titans is likely to intensify as deep-pocketed tycoons seek to dominate the supply of building materials vital to fuel India’s infrastructure boom.

Advertising 2

Content of the article

Ambitious upstart Adani and sector leader UltraTech have struck six deals in less than two years, with cement maker Birla announcing a seventh on Sunday to take control of the coveted regional player. At least half a dozen smaller rivals are still up for grabs.

“Adani’s philosophy every time it enters a sector is to dominate and fight competitors on a war footing,” said Aditya Kondawar, Pune-based partner at wealth management firm Complete Circle Capital Pvt. “After Adani came in, there was a new aggression in the sector that made UltraTech expand as well. When the competition is at the door, you can go up or get away.

Adani Group’s big bang entry in 2022 upended the local pecking order – becoming the No. 2 cement maker overnight with the acquisition of Ambuja Cements Ltd and ACC Ltd. – but spent much of 2023 fire-fighting after the scathing report of Hindenburg Research.

The port-to-power conglomerate only returned to its expansionist ways in full this year, sparking a turf war on cement as entrenched incumbent Birla dug in its heels.

M&A Warchest

Content of the article

Advertising 3

Content of the article

Adani, which has dropped four acquisitions in the sector since its entry, wants to increase its annual production capacity to 140 million tonnes by 2028.

The group is looking for more cement assets to expand its reach, acquire a key raw material – limestone reserves – and has a war chest of about $4.5 billion for acquisitions over the next two years, according to people familiar with the discussions who spoke about the situation. of anonymity.

The Adani Group, which controls India’s largest private port operator, aims to cut costs significantly even if it cannot match the cost efficiency of Chinese cement makers, the people said.

Sea or inland water transportation costs a fraction of the cost of transportation through trucks and the Adani Ports & Special Economic Zone Ltd. network. will be helpful there, this person added. Adani Ports has planned a 2 million tonne cement grinding unit at its transshipment terminal in Kerala. Green energy from the group’s companies could help pare fuel costs, the person said.

District leadership

To strengthen the moat around its leadership, UltraTech acquired a smaller rival last year. In June, it bought a minority stake in the Chennai-based cement maker in June before slimming down to majority control this week – a move seen as a sign of territory to fight Adani. It also surrounds other targets.

Advertising 4

Content of the article

Cement giant Birla will continue to expand its operations and acquire assets to reach 200 million tonnes of annual capacity by 2027, people familiar with Birla’s strategy said.

A representative for the Adani Group declined to comment while UltraTech did not respond to an emailed request for comment.

Mission to Build

Prime Minister Narendra Modi’s mission to build everything from airports and power facilities to roads, bridges and tunnels will push India’s infrastructure investment to 15 trillion rupees ($179.2 billion) by March 2026, according to Crisil Ratings.

This will generate huge demand for cement, outstripping supply in the coming years and creating an opportunity for expansion that neither Adani, Asia’s second-richest man, nor Birla can resist.

Adani, which acquired Penna Cement Industries Ltd last month, has been eyeing Jaypee Group as well as Orient Cement Ltd., according to local media reports. Orient Cement is now also attracting interest from UltraTech.

Others such as Saurashtra Cement Ltd., Mangalam Cement Ltd., Vadraj Cement Ltd. and Bagalkot Cement Industries Ltd. could also be a target, people familiar with the matter said.

Advertising 5

Content of the article

The south of India is the most fragmented cement market in the country, with the highest installed capacity and many companies that have not increased their capacity for many years, Sanjeev Kumar Singh and Mudit Agarwal, analysts at Motilal Oswal Financial Services Ltd. wrote in the July report.

“It is possible that some of these entities may consider exiting the industry if offered favorable valuations,” Singh and Agarwal wrote.

Hunting Field

That makes this geography a perfect hunting ground for billionaires, who have started making deals.

Adani’s purchase of Penna Cement in June to boost its footprint in south India. Days later, UltraTech bought a 23% stake in India Cements Ltd., a Chennai-based company with nearly 14.5 million tons of capacity, in a move to block any possible overtures by Adani. On Sunday, the Birla company bought nearly a third of India Cements for $472 million, taking its total stake to over 55%.

This “enables UltraTech to serve the southern market more effectively” and accelerates its path to the 200 million tonne target, Birla said in a statement on Sunday.

Advertising 6

Content of the article

“A move away from acquisitions in the cement industry is inevitable because of government spending on infrastructure and housing,” said Aveek Mitra, founder of Aveksat Investment Advisory in New Delhi.

India has around 100 registered and closely-held cement manufacturers, with most having a small market share, according to Mitra.

“An asset block of 28 million tonnes is in the pipeline for acquisition” and M&A deals will continue as large incumbents look to retain market share, Anupama Reddy, head of corporate ratings at ICRA Ltd. wrote in a June 13 note. .

Of course, even with all its aggressive expansion it will still be difficult for Adani to topple UltraTech. The gap between the two rivals is significant and will remain, based on announced capacity additions.

Investigate Anti-Trust

Adani and UltraTech should also be mindful of scrutiny from India’s anti-trust watchdog and avoid acquisitions in geographies with high concentrations of market share.

While demand for cement is strong now, it could slow down in four or five years, according to Jyoti Gupta, research analyst at Nirmal Bang Institutional Equities. Smaller players like Dalmia Bharat Ltd., Shree Cement Ltd. and JSW Cement Ltd. also increase.

“When infrastructure spending is reduced, and there is a lot of residential property, will there be enough demand to use all this added capacity?” said Gupta.

Content of the article