(Bloomberg) – Advanced Micro Devices Inc. suffered its biggest stock drop in more than a month after the company announced a new artificial intelligence chip but did not provide the expected information on customers or financial performance.

Most Read from Bloomberg

The stock fell 4% to $164.18 on Thursday, making it the biggest one-day decline since September 3. Shares of the company, which hosted the event in San Francisco on Thursday, remain up 11% this year.

AMD has emerged as the biggest contender for Nvidia Corp in the lucrative market for artificial intelligence processors, and Chief Executive Officer Lisa Su has argued that the latest chips will exceed some of the capabilities of rivals. Computer systems based on the AMD MI325X processor will be available soon and have an edge over the Nvidia H100 running machine, he said at the event. The MI325X’s use of a new type of memory chip will give it better performance in AI software – a process known as inference – he said.

“It’s a very fast-growing market,” Su said in an interview with Bloomberg Television’s Ed Ludlow. “We see this as a multiyear opportunity.”

The Santa Clara, California-based company is trying to break Nvidia’s dominance in AI accelerators – chips that have become essential to the development of artificial intelligence systems. Like Nvidia, AMD is committed to bringing new accelerators every year, increasing the pace of innovation.

Still, AMD has a long way to go to match Nvidia, and Wall Street has been waiting for signs of progress. That may not come until the company’s quarterly earnings report, which is expected later this month.

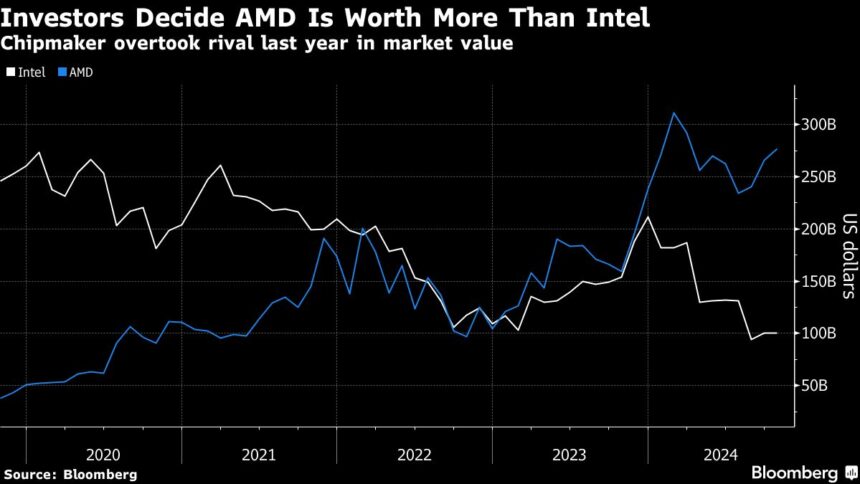

Under Su, who just marked his 10th anniversary in the top job at AMD, the company has eclipsed longtime nemesis Intel Corp. in market value. But both companies were surprised by the industry’s embrace of AI accelerators.

Of the two, AMD has responded faster and is Nvidia’s closest competitor. AMD has set a target of $4.5 billion in revenue from new types of chips for this year, a rapid increase.

Su has said that the overall market for the chip will reach $400 billion in 2027. On Thursday, he said the company expects that amount to reach $500 billion in 2028.

At the event, Su also said that the company is releasing a new line of server processors based on “Turin” technology, making a new push into a market dominated by Intel.

The computers will be sold with AMD’s fifth-generation EPYC central processing unit, or CPU, he said. The chip has as many as 192 processor cores and can outperform the latest Intel products, he said.

The company says it currently has 34% of the market for this category of chips when measured by revenue. Although Intel still dominates the segment, it has a 99% share.

Su said he expects growth in demand for AI and that the industry is still “just starting” to adopt the new technology.

Separately, Su said that AMD has no current plans to change the suppliers it uses for advanced manufacturing. But the company wants more geographical diversity in terms of production, and is looking to work with Taiwan Semiconductor Manufacturing Co.’s new Arizona facility. Su refused to use Samsung Electronics Co or Intel in the future. He said AMD is keeping an open mind.

“We’re always looking at the manufacturing landscape and always thinking about how we can have the most resilient supply chain,” he said in a Bloomberg Television interview.

AMD has a different strategy than Nvidia and resonating with customers, Su said. Larger competitors offer complete systems, including models and software, that AMD believes are closed and proprietary. AMD is more open to working with other companies, even Intel and Nvidia, he said.

“The difference is that we don’t think we’re the only ones with good ideas,” he said.

–With assistance from Ed Ludlow.

(Update with CEO interview comments starting in the fourth paragraph.)

Most Read from Bloomberg Businessweek

© 2024 Bloomberg LP