Tech stocks lost some of their luster in the market as heightened expectations of the proliferation of artificial intelligence (AI) technology put companies in the sector under pressure to deliver exceptional growth every quarter.

Share from NvidiaFor example, the retreat over the past few weeks even as GPU leaders posted better-than-expected quarterly results and guidance that exceeded Wall Street estimates. However, a closer look at the outlook for the AI market suggests that the tech sector may not last long. After all, Bloomberg expects the generative AI market to reach $1.3 trillion by 2032, with a compound annual growth rate of 42% through the end of that period.

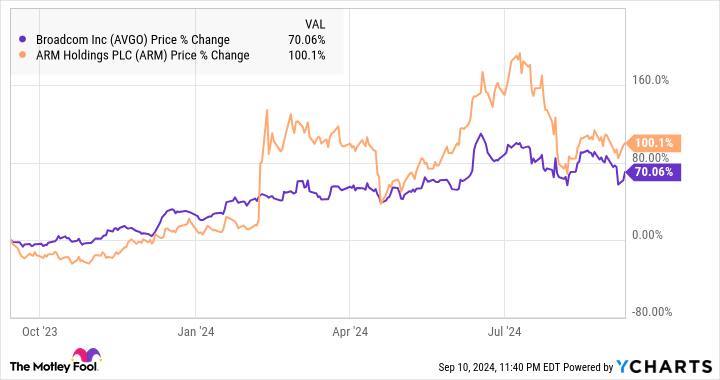

So, it’s not surprising that AI stocks will return to good investors, as they can continue to grow healthily for a long time. That is why it would be a good idea for investors to buy shares Broadcom (NASDAQ: AVGO) and Arm Holdings (NASDAQ: ARM)two of which have been significantly withdrawn since the beginning of July.

Both companies play a major role in the proliferation of AI. More importantly, the results make it clear that AI is giving businesses a great boost. It’s not surprising that these stocks are parabolic behind their better results. In the investment world, a parabolic move refers to a rapid increase in a company’s stock price over a short period of time – similar to the right side of a parabolic curve – and Broadcom and Arm have enjoyed it in the past.

The case for Broadcom

Broadcom is a diversified technology company that designs various types of chips, such as smartphone connectivity chips, application-specific integrated circuits (ASICs), and ethernet switches, and now also provides enterprise cloud infrastructure solutions after the VMware acquisition. But the semiconductor segment remains the biggest source of revenue, generating 56% of the top line in the last quarter.

More specifically, Broadcom’s semiconductor business generated $7.3 billion in the third quarter of fiscal 2024, translating to an annual income level of about $30 billion. The company estimates it will generate $12 billion this year from AI chip sales, which suggests the AI chip market could account for 40% of semiconductor revenue.

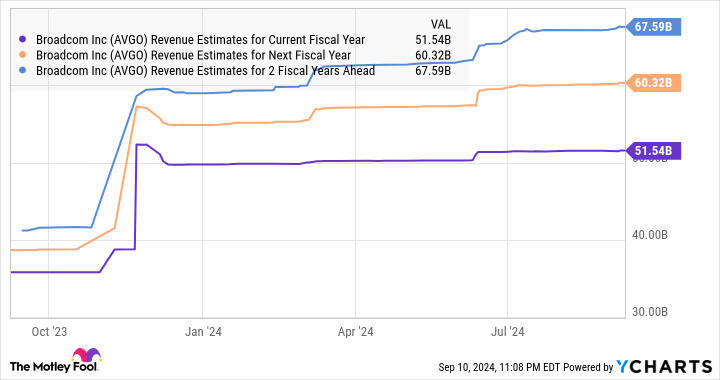

Based on Broadcom’s fiscal 2024 revenue forecast of $51.5 billion, AI is on track to account for 23% of the top line. But the best part is that Broadcom’s AI business could be the start of an impressive growth curve. That’s because it could be sitting on an AI-related revenue opportunity worth $150 billion that could be turned into revenue over the next five years, according to JPMorgan.

The investment bank said the company’s AI revenue could record a compound annual growth rate of 30% to 40% over the period. This may be one of the reasons why analysts have increased their revenue growth expectations for Broadcom over the next few fiscal years.

However, it is not surprising that the expectations are higher considering the huge AI-related opportunity that Broadcom is sitting on. Because of this, investors could benefit from a 14% slide in Broadcom shares since early July. It is currently trading at 26 times forward earnings, and may not be available at that price for a long time.

2. Arm Holdings

Arm Holdings lost ground in the last market, losing 23% of its value since mid-July. However, the critical role that Arm plays in the global semiconductor market puts it in a solid position to benefit from the proliferation of AI in many industries.

The British company licenses chip architecture and designs to chipmakers, who pay license fees up front to use intellectual property. Arm also earns royalties for every shipment of products that contain chips made using its architecture and designs. With the AI chip market expected to increase its annual growth rate by more than 40% until 2032, Arm is sitting on a golden growth opportunity.

The company’s AI-specific chip architecture is used in applications ranging from smartphones to smart homes to cloud computing to autonomous driving. Arm estimates that more than 100 billion AI-ready chips made using its architecture could be shipped by the end of the next fiscal year, due to growth in shipments of AI devices such as smartphones and personal computers.

For comparison, 28.6 billion Arm-based chips were shipped in fiscal 2024, which ends on March 31. As such, Arm’s forecast of chip shipments of more than 100 billion in fiscal 2025 and 2026 suggests that top-line growth may be very rapid. . Management’s guidance range for fiscal 2025 is $3.8 billion to $4.1 billion. If it hits the midpoint of that range, it will be a top jump of 22%.

However, Arm shares rose 7% on September 9 following Apple‘s Open iPhone 16. That’s because Apple reportedly used the British company AI-focused architecture Armv9 to design the processor powering the new smartphone model. Arm’s management said that the Armv9 architecture provides twice the royalties of the previous Armv8 architecture, so iPhone 16 sales can lead to serious growth.

Apple’s iPhone shipments are expected to grow rapidly as new models become available, as they can support generative AI features on the device. So, there’s a good chance that Arm can generate faster-than-expected growth this year, and even stronger growth in the future.

Because of all this, the possibility of Arm stock making a parabolic movement cannot be denied. Investors should therefore consider acting quickly and take advantage of the decline in the company’s stock price.

Should you invest $1,000 in Broadcom right now?

Before you buy shares in Broadcom, consider this:

At Motley Fool Stock Advisor The team of analysts only recognized what they believed it to be 10 best stocks to buy investors now… and Broadcom is not one of them. 10 stocks that made the cut could produce monster returns in the coming years.

Try when Nvidia created this list on April 15, 2005… if you invest $1,000 when you recommend, you would have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. At Stock Advisor service already more than four return of the S&P 500 since 2002*.

View 10 stocks »

* The Stock Advisor returns on September 9, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Apple, JPMorgan Chase, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Can Go Parabolic was originally published by The Motley Fool